Latest Bank of Canada Business Sentiment

DLC Canadian Mortgage Experts • July 7, 2020

The Bank of Canada released its Summer Business Outlook Survey (BOS)*

this morning, covering an interview period from mid-May to early June. In all provinces and all sectors, the sentiment was hugely negative owing to the impact of the pandemic and falling oil prices.

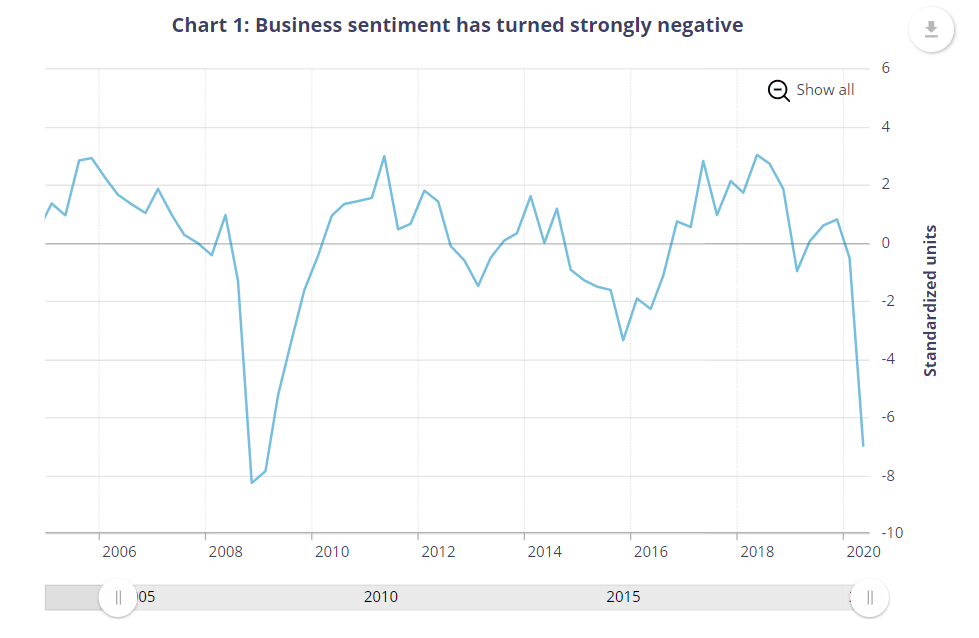

Since the previous survey, conducted before concerns about COVID-19 has intensified, but as oil prices had already started to fall, business confidence plunged. Surprisingly, however, the business sentiment was not as negative as during the 2007-09 global financial crisis (see Chart 1 below). This was mainly due to the government support offered to cushion the blow of the pandemic. Also, many firms expect a reasonably quick rebound in operations after a temporary decline in sales, unlike the 2007–09 crisis when businesses anticipated persistent weakness in demand.

Highlights of the BOS:

Since the previous survey, conducted before concerns about COVID-19 has intensified, but as oil prices had already started to fall, business confidence plunged. Surprisingly, however, the business sentiment was not as negative as during the 2007-09 global financial crisis (see Chart 1 below). This was mainly due to the government support offered to cushion the blow of the pandemic. Also, many firms expect a reasonably quick rebound in operations after a temporary decline in sales, unlike the 2007–09 crisis when businesses anticipated persistent weakness in demand.

Highlights of the BOS:

- Forward-looking sales indicators have collapsed. Many businesses referred to elevated uncertainty. Still, roughly half of firms anticipate that their sales will recover to pre-pandemic levels within the next year.

- Businesses in most regions and sectors intend to cut their investment spending significantly. Hiring plans are muted, although a quarter of firms plan to refill some positions after recent layoffs.

- Reports of capacity pressures and labour shortages have fallen significantly. This suggests a substantial widening in economic slack.

- Expectations for input and output price growth, as well as for overall inflation, are all down considerably.

- Credit conditions have tightened significantly, but government measures are a helpful offset.

_______________________________

*The Business Outlook Survey summarizes interviews conducted by the Bank’s regional offices with the senior management of about 100 firms selected in accordance with the composition of the gross domestic product of Canada’s business sector. This survey was conducted by phone and video conference from May 12 to June 5, 2020.

*The Business Outlook Survey summarizes interviews conducted by the Bank’s regional offices with the senior management of about 100 firms selected in accordance with the composition of the gross domestic product of Canada’s business sector. This survey was conducted by phone and video conference from May 12 to June 5, 2020.

BoC Consumer Expectations Survey--Q2 2020

This survey was conducted from May 11 to June 1, in the throws of the ongoing pandemic. Of most concern to consumers was the prospect of losing their jobs. Many believed finding another job would be difficult. As well, consumer expectations for wage growth declined significantly.

According to the survey, consumer expectations for interest rates have fallen sharply, although they expect rates to rise over the 1-year to 5-year horizon, albeit moderately. At the same time, expectations for average house price growth have dropped to zero for Canada as a whole. For Ontario, respondents expect the average home price to rise by 1% over the next year. In BC, people see home prices falling a moderate -0.30%, with Albertan respondents suggesting a price decline of -4.3% (see the chart below). It is important to note that oil prices have risen considerably since the completion of this survey. All of these forecasts are well below the figures in the Q1 study.

It is noteworthy that all of these expectations are well below the CMHC forecast for the national average home price to fall 9%-to-18% over the coming year.

This article was written by DLC's chief economist Dr Sherry Cooper.

RECENT POSTS

Did you know there’s a program that allows you to use your RRSP to help come up with your downpayment to buy a home? It’s called the Home Buyer’s Plan (or HBP for short), and it’s made possible by the government of Canada. While the program is pretty straightforward, there are a few things you need to know. Your first home (with some exceptions) To qualify, you need to be buying your first home. However, when you look into the fine print, you find that technically, you must not have owned a home in the last four years or have lived in a house that your spouse owned in the previous four years. Another exception is for those with a disability or those helping someone with a disability. In this case, you can withdraw from an RRSP for a home purchase at any time. You have to pay back the RRSP You have 15 years to pay back the RRSP, and you start the second year after the withdrawal. While you won’t pay any tax on this particular withdrawal, it does come with some conditions. You’ll have to pay back the total amount you withdrew over 15 years. The CRA will send you an HBP Statement of Account every year to advise how much you owe the RRSP that year. Your repayments will not count as contributions as you’ve already received the tax break from those funds. Access to funds The funds you withdraw from the RRSP must have been there for at least 90 days. You can still technically withdraw the money from your RRSP and use it for your down-payment, but it won’t be tax-deductible and won’t be part of the HBP. You can access up to $35,000 individually or $70,00 per couple through the HBP. Please connect anytime if you’d like to know more about the HBP and how it could work for you as you plan your downpayment. It would be a pleasure to work with you.

If you’re new to the home buying process, it’s easy to get confused by some of the terms used. The purpose of this article is to clear up any confusion between the deposit and downpayment. What is a deposit? The deposit is the money included with a purchase contract as a sign of good faith when you offer to purchase a property. It’s the “consideration” that helps make up the contract and binds you to the agreement. Typically, you include a certified cheque or a bank draft that your real estate brokerage holds while negotiations are finalized when you offer to purchase a property. If your offer is accepted, your deposit is held in your Realtor’s trust account. If your offer is accepted and you commit to buying the property, your deposit is transferred to the lawyer’s trust account and included in your downpayment. If you aren’t able to reach an agreement, the deposit is refunded to you. However, if you commit to buying the property and don’t complete the transaction, your deposit could be forfeit to the seller. Your deposit goes ahead of the downpayment but makes up part of the downpayment. The amount you put forward as a deposit when negotiating the terms of a purchase contract is arbitrary, meaning there is no predefined or standard amount. Instead, it’s best to discuss this with your real estate professional as your deposit can be a negotiating factor in and of itself. A larger deposit may give you a better chance of having your offer accepted in a competitive situation. It also puts you on the hook for more if something changes down the line and you cannot complete the purchase. What is a downpayment? Your downpayment refers to the initial payment you make when buying a property through mortgage financing. In Canada, the minimum downpayment amount is 5%, as lenders can only lend up to 95% of the property’s value. Securing mortgage financing with anything less than 20% down is only made possible through mortgage default insurance. You can source your downpayment from your resources, the sale of a property, an RRSP, a gift from a family member, or borrowed funds. Example scenario Let’s say that you are looking to purchase a property worth $400k. You’re planning on making a downpayment of 10% or $40k. When you make the initial offer to buy the property, you put forward $10k as a deposit your real estate brokerage holds in their trust account. If everything checks out with the home inspection and you’re satisfied with financing, you can remove all conditions. Your $10k deposit is transferred to the lawyer’s trust account, where will add the remaining $30k for the downpayment. With your $40k downpayment made, once you sign the mortgage documents and cover the legal and closing costs, the lender will forward the remaining 90% in the form of a mortgage registered to your title, and you have officially purchased the property! If you have any questions about the difference between the deposit and the downpayment or any other mortgage terms, please connect anytime. It would be a pleasure to work with you.