Canadian GDP Down in April With Modest Uptick in May

DLC Canadian Mortgage Experts • June 30, 2020

The pandemic shutdown put every sector of the economy into a medically induced coma, so it was no surprise that the first full month of lockdown would be ugly. Indeed, consensus estimates were worse than the 11.6% drop in economic activity reported this morning by Statistics Canada (see chart below). April's contraction followed the March decline of 7.5%. All 20 industrial sectors of the economy were depressed, producing the largest monthly slump since the series started in 1961.

Services-producing sectors recorded a 9.7% drop, led by retail trade and transportation. Goods-producing industries saw a 17% decline in output. The economy at the end of April was 18.2% lower than its February level, the month before the COVID-19 measures began.

Nothing like this has ever happened in our lifetimes; we are in uncharted territory, and the virus will determine the future course of the economy. Policymakers in Canada have done a commendable job in cushioning the blow of the lockdown and its lasting impact on the economy. Importantly, Canada has posted a sustained decline in the number of cases owing to the enforced lockdown measures. Canada's success is in direct contrast to the disastrous surge in COVID cases in roughly 20 US states where the economy opened prematurely, and public health initiatives were grossly mismanaged. It is crucial, however, that we not assume the worst is over and let down our guard. The World Health Organization said yesterday that "the worst was yet to come." Moreover, the timing of a vaccine is unknown, and Canada remains susceptible to contamination from incoming American truckers, travellers and virus spread if we open too quickly.

Highlights of the economic contraction in April were:

Nothing like this has ever happened in our lifetimes; we are in uncharted territory, and the virus will determine the future course of the economy. Policymakers in Canada have done a commendable job in cushioning the blow of the lockdown and its lasting impact on the economy. Importantly, Canada has posted a sustained decline in the number of cases owing to the enforced lockdown measures. Canada's success is in direct contrast to the disastrous surge in COVID cases in roughly 20 US states where the economy opened prematurely, and public health initiatives were grossly mismanaged. It is crucial, however, that we not assume the worst is over and let down our guard. The World Health Organization said yesterday that "the worst was yet to come." Moreover, the timing of a vaccine is unknown, and Canada remains susceptible to contamination from incoming American truckers, travellers and virus spread if we open too quickly.

Highlights of the economic contraction in April were:

- Air transportation plummeted 93.7%, reflecting the reduced movement of both goods and passengers.

- Accommodation and food services dropped 42.4%, following a 37.1% decline in March. The sector was down a whopping 64% from its level of activity in February.

- Real estate declined 3.5% in April following a 1.2% decline in March. Activity at the offices of real estate agents and brokers plunged 57.2% in April, as home resale activity in nearly all major urban centres came to a standstill.

- Personal and laundry services (provided by hair salons, beauty parlours, funeral homes, dry cleaners, etc.) dropped 39.3%, while private household services offered by maids, cooks, gardeners, etc. fell more than one-third.

The good news is that StatsCan said today that preliminary information indicates an approximate 3.0% increase in real GDP for May. Output across several industrial sectors--including manufacturing, retail and wholesale as well as the public sector (health, education and public administration)--increased in May, as activities gradually resumed in phases in different regions of the country.

Consumer Providing Support

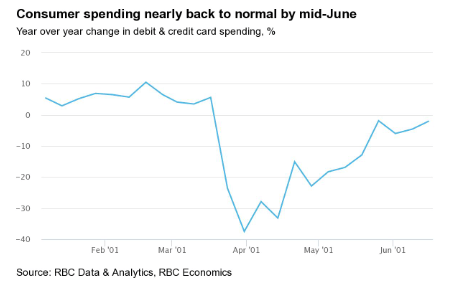

On a more positive note, the economists at Royal Bank reported yesterday that personal spending had rebounded sharply since early April, judging by debit and credit card purchases (see chart below). Overall card volumes were near year-earlier levels by June 16th, down 2% year-over-year. Reopening across the country spurred spending at clothing stores and on personal services such as haircuts and massages. Early indications suggest online shopping remains popular despite the opening of bricks and mortar stores.

The reopening of the economy, along with federal government income support, has boosted consumer confidence and spending. The Canadian Emergency Response Benefit program (CERB) provides eligible consumers who had stopped working because of COVID $2,000 per four-week period. Trudeau recently extended the CERB from 16 weeks to 20 weeks.

Consumer confidence has climbed for nine straight weeks according to the Bloomberg Nanos Canadian Confidence Index, a weekly composite measure of financial health and economic expectations. The index currently stands at 46. That's up nearly 10 points from early May and is slowly nearing the 50-point mark, above which views are considered to be net positive.

One unintended problem, however, is that the CERB is becoming a disincentive to work. If a recipient earns more than $1,000 per month, he or she loses the full $2,000 payment. Also, for some, the CERB allotment is more than they earned at their previous job, so they are reluctant to return to work when their businesses open. The stipend is now making it difficult for restaurants, retail stores, cleaning services and trades to get their workers back. The government needs to start winding down direct cash support, but instead, it extended the payments until the end of August.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was published with permission.

RECENT POSTS

Did you know there’s a program that allows you to use your RRSP to help come up with your downpayment to buy a home? It’s called the Home Buyer’s Plan (or HBP for short), and it’s made possible by the government of Canada. While the program is pretty straightforward, there are a few things you need to know. Your first home (with some exceptions) To qualify, you need to be buying your first home. However, when you look into the fine print, you find that technically, you must not have owned a home in the last four years or have lived in a house that your spouse owned in the previous four years. Another exception is for those with a disability or those helping someone with a disability. In this case, you can withdraw from an RRSP for a home purchase at any time. You have to pay back the RRSP You have 15 years to pay back the RRSP, and you start the second year after the withdrawal. While you won’t pay any tax on this particular withdrawal, it does come with some conditions. You’ll have to pay back the total amount you withdrew over 15 years. The CRA will send you an HBP Statement of Account every year to advise how much you owe the RRSP that year. Your repayments will not count as contributions as you’ve already received the tax break from those funds. Access to funds The funds you withdraw from the RRSP must have been there for at least 90 days. You can still technically withdraw the money from your RRSP and use it for your down-payment, but it won’t be tax-deductible and won’t be part of the HBP. You can access up to $35,000 individually or $70,00 per couple through the HBP. Please connect anytime if you’d like to know more about the HBP and how it could work for you as you plan your downpayment. It would be a pleasure to work with you.

If you’re new to the home buying process, it’s easy to get confused by some of the terms used. The purpose of this article is to clear up any confusion between the deposit and downpayment. What is a deposit? The deposit is the money included with a purchase contract as a sign of good faith when you offer to purchase a property. It’s the “consideration” that helps make up the contract and binds you to the agreement. Typically, you include a certified cheque or a bank draft that your real estate brokerage holds while negotiations are finalized when you offer to purchase a property. If your offer is accepted, your deposit is held in your Realtor’s trust account. If your offer is accepted and you commit to buying the property, your deposit is transferred to the lawyer’s trust account and included in your downpayment. If you aren’t able to reach an agreement, the deposit is refunded to you. However, if you commit to buying the property and don’t complete the transaction, your deposit could be forfeit to the seller. Your deposit goes ahead of the downpayment but makes up part of the downpayment. The amount you put forward as a deposit when negotiating the terms of a purchase contract is arbitrary, meaning there is no predefined or standard amount. Instead, it’s best to discuss this with your real estate professional as your deposit can be a negotiating factor in and of itself. A larger deposit may give you a better chance of having your offer accepted in a competitive situation. It also puts you on the hook for more if something changes down the line and you cannot complete the purchase. What is a downpayment? Your downpayment refers to the initial payment you make when buying a property through mortgage financing. In Canada, the minimum downpayment amount is 5%, as lenders can only lend up to 95% of the property’s value. Securing mortgage financing with anything less than 20% down is only made possible through mortgage default insurance. You can source your downpayment from your resources, the sale of a property, an RRSP, a gift from a family member, or borrowed funds. Example scenario Let’s say that you are looking to purchase a property worth $400k. You’re planning on making a downpayment of 10% or $40k. When you make the initial offer to buy the property, you put forward $10k as a deposit your real estate brokerage holds in their trust account. If everything checks out with the home inspection and you’re satisfied with financing, you can remove all conditions. Your $10k deposit is transferred to the lawyer’s trust account, where will add the remaining $30k for the downpayment. With your $40k downpayment made, once you sign the mortgage documents and cover the legal and closing costs, the lender will forward the remaining 90% in the form of a mortgage registered to your title, and you have officially purchased the property! If you have any questions about the difference between the deposit and the downpayment or any other mortgage terms, please connect anytime. It would be a pleasure to work with you.