Strong June Jobs Report in Canada

Robust Jobs Report in June, Much Better Than Expected

From February to April, 5.5 million Canadian workers--30% of the workforce-- either lost their jobs or saw their hours significantly scaled back. Yet, nearly 8.2 million Canadians receive the $2,000 per month Canadian Emergency Response Benefit (CERB) payments. Is this a disincentive for some workers to return to work?

CERB has cushioned the blow of the pandemic on households and helped to boost consumer confidence. Nevertheless, keep it in mind in assessing the speed at which the jobless are returning to work.

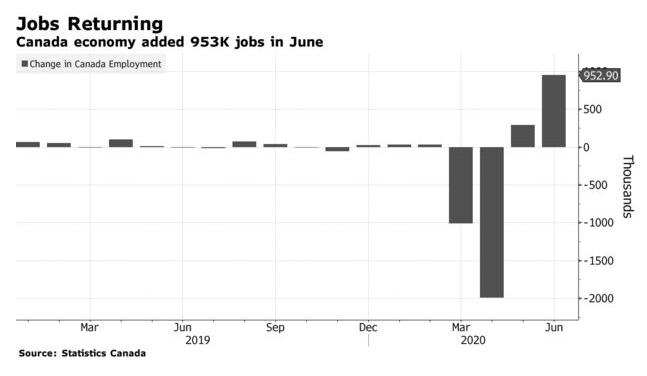

Blowout Jobs Report in June

By the week of June 14 to June 20, the number of workers affected by the COVID-19 economic shutdown was 3.1 million, down 43% since April.

Building on an initial recovery of 290,000 in May, employment rose by nearly one million in June (+953,000; +5.8%), with gains split between full-time work (+488,000 or +3.5%) and part-time work (+465,000 or +17.9%). With these two consecutive monthly increases, the total level of employment in June was 1.8 million (-9.2%) lower than in February.

The speed of job recovery has been much faster than in previous recessions, just as the pandemic-induced decline in jobs was more sudden. Men are closer to pre-shutdown employment levels than women in all age groups. The hardest-hit sectors, accommodation, food services, retail trade and personal services are heavily dominated by female employees. The burden of daycare with schools closed likely fell more heavily on women as evidenced by the higher unemployment rate for women with young children.

Unemployment Rate Drops in June After Reaching a Record High in May

The unemployment rate was 12.3% in June, a drop of 1.4 percentage points from a record-high of 13.7% in May. While this was the most significant monthly decline on record, the unemployment rate remains much higher than in February, when it was 5.6%.

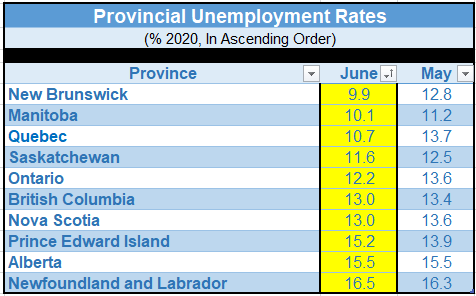

Employment Increases in All Provinces

In Ontario , where the easing of COVID-19 restrictions began in late May and expanded on June 12, employment rose by 378,000 (+5.9%) in June, the first increase since the COVID-19 economic shutdown. The proportion of employed people who worked less than half of their usual hours declined by 6.5 percentage points to 14.1% in Ontario. The unemployment rate declined 1.4 percentage points to 12.2% as the number of people on temporary layoff declined (see table below).

In Toronto, where the easing of some COVID-19 restrictions was delayed until June 24, the recovery rate was slightly below that of Ontario in June. The employment level in Toronto was 89.6% of the February level, compared with 94.5% for the rest of the province (not adjusted for seasonality).

Quebec recorded employment gains of 248,000 (+6.5%) in June, adding to similar gains (+231,000) in May and bringing employment to 92.2% of its February level. At the same time, the number of unemployed people in the province declined for the second consecutive month in June (-119,000), pushing the unemployment rate down 3.0 percentage points to 10.7%. The decline in unemployment in Quebec was entirely driven by fewer people on temporary layoff.

The number of people employed in British Columbia rose by 118,000 (+5.4%) in June, following an increase of 43,000 in May. The proportion of employed people who worked less than half of their usual hours declined by 2.9 percentage points to 14.6%. The number of unemployed in the province was little changed in June, and the unemployment rate edged down 0.4 percentage points to 13.0%.

In the Western provinces, employment increased in Saskatchewan (+30,000) for the first time since the COVID-19 economic shutdown and rose for the second consecutive month in both Alberta (+92,000) and Manitoba (+29,000).

In New Brunswick , the first province to begin easing COVID-19 restrictions, employment increased by 22,000 in June. Combined with May gains, this brought employment in the province to 97.1% of its pre-COVID February level, the most complete employment recovery of all provinces to date.

Employment increased for the second consecutive month in Nova Scotia (+29,000), Newfoundland and Labrador (+6,000) and Prince Edward Island (+1,700).

Sectoral Variation in Job Growth

Those sectors that require proximity of workers to customers (accommodation and food services and retail trade other than online) remained hardest hit by the medically-induced job losses. As well, a high proportion of jobs in both the health care and social assistance and educational services industries involve proximity to others. Employment increased in all of these sectors, but remain well below pre-COVID levels.

Also hard hit was employment in businesses that rely on the gathering of large groups (information, culture and recreation industry). This sector was subject to some of the earliest public health restrictions in the form of the size of gatherings as all provinces continue to limit the number of people allowed to gather in public.

In several services-producing industries—such as wholesale trade, public administration, and finance, insurance, real estate and rental and leasing—fewer than 40% of jobs involve proximity with others. In many of these industries, employment in June was at or near pre-COVID-shutdown levels.

Monthly employment gains were recorded in wholesale trade (+38,000) and finance, insurance, real estate and rental and leasing (+17,000). Employment returned to pre-COVID-19 levels in wholesale trade, while it was 1.0% lower than pre-COVID-19 levels in finance, insurance, real estate and rental and leasing.

In most industries where few jobs require close physical proximity with others, workers have shifted to working from home on a large scale. In finance, insurance, real estate and rental and leasing, 6 in 10 (61.2%) were working from home during the week of June 14, more than double the proportion (28.5%) who usually do so. A larger-than-usual percentage of workers also continued to work from home in professional, scientific and technical services (73.2%) and public administration (53.8%).

After avoiding significant job losses in the first month of the COVID-19 economic shutdown, both the construction and manufacturing industries experienced heavy losses in April, followed by an initial recovery in May.

In June, employment in construction was 157,000 higher than in April, reaching 89.3% of its February level. In the manufacturing sector, employment gains in May and June totalled 160,000, bringing employment to 91.9% of its February level.

In each of the construction and manufacturing industries, both the proportion of people working less than 50% of their usual work hours and the number of people on temporary layoff fell markedly in June. Construction recorded a 53.8% decrease in the number of people on temporary layoff (not adjusted for seasonality).

Bottom Line

This was an unambiguously strong jobs report, and we will likely see a continued rebound in employment as long as the economy can open further. Undoubtedly, however, Canada's economy is still digging itself out of a deep hole, and some jobs are gone for good. But new sectors are growing rapidly as the pandemic accelerated the technological forces that were already in train. I expect to see strong job growth in the following new and burgeoning areas: telemedicine, big data, artificial intelligence, cloud services, cybersecurity, 5G, driverless transportation and clean energy. Online shopping will also continue to proliferate as Canadians have learned to use delivery services and online retail.

These new jobs require training and a high degree of expertise. Those who have suffered permanent job losses will need to adapt. What we do not want to see is government programs that slow the rate of adaptation or support businesses that are no longer viable. Support for those most in need with little likelihood of adaptation will remain necessary.

This article was written by Dr Sherry Cooper, Chief Economist for DLC.