US Fed Cuts Overnight Rate But Markets Plummet

Fed takes emergency action on Sunday as virus pushes economy toward recession.

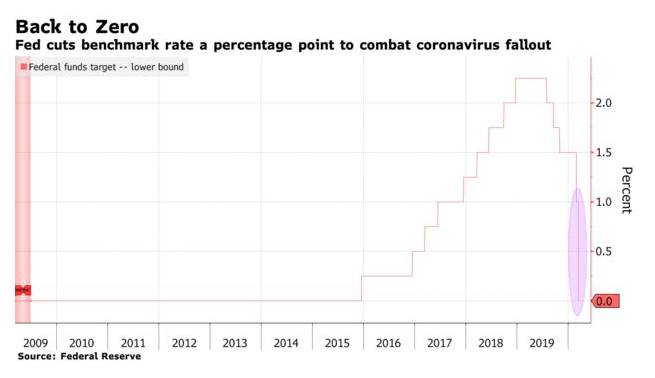

In an unprecedented Sunday afternoon meeting, the US Federal Reserve cut their key policy rate by 100 basis points (bps) to a level of 0%-to-0.25% (see chart below). Also, the Committee announced increased access to the discount window where the Fed makes loans to banks. The Fed is the lender-of-last-resort and is signalling that it will provide liquidity wherever needed. As well, with interest rates already so low, the Fed is well aware that rate cuts can only do so much. Thus, they are returning to quantitative easing--the buying of large volumes of U.S. government Treasury bills and bonds as well as mortgage-backed securities (MBS), to inject liquidity into the financial system.

The Treasury and US MBS markets are usually the deepest, most liquid markets in the world. But over the past two weeks, liquidity has dried up. Financial instability has risen sharply with the high level of volatility. Banks have experienced significant withdrawals as consumers are hoarding cash like everything else. The cost of funds to banks has risen sharply because of the enhanced perception of risk. With the collapse in oil prices, banks exposed to the oil sector are building up reserves for nonperforming loans. As businesses everywhere in nearly every sector shutdown, the risk of delinquencies rises further. Consumers who are housebound spend less money, and those who are freelancers or hourly wage earners might not get paid. Moreover, the shuttering of schools puts an added burden on parents who have no other daycare options for their kids.

All of this disruption, which according to the Center for Disease Control, could last months--the CDC recommended yesterday the shutdown of meetings of more than 50 people for eight weeks--has led to rising concern about the riskiness of banks. Bank shares have plummeted, and the yields on bank bonds have surged. Besides, banks and other mortgage lenders are fearful of being inundated with requests for refinancings, especially in the US, where penalties for breaking a mortgage are much lower than in Canada. Because of the refinancing surge in the US, the price of MBSs has fallen sharply, raising their yields and making the market highly illiquid.

The rising risk premiums, likely recession and illiquidity are causing banks in Canada and the US to raise some mortgage rates. Lenders are tightening the discount off the prime rate on variable-rate mortgage loans. Some fixed rates have edged higher as well. Such spread widening between mortgage rates and government yields happened during the financial crisis. Bank balance sheets will expand as troubled businesses and consumers extend their borrowings on their open lines of credit. Many will be unable to make timely interest payments. Loan loss reserves, already climbing, will rise further. Liquid deposits will be depleted as many are forced to live off of savings while shying away from selling stocks at markedly depressed prices.

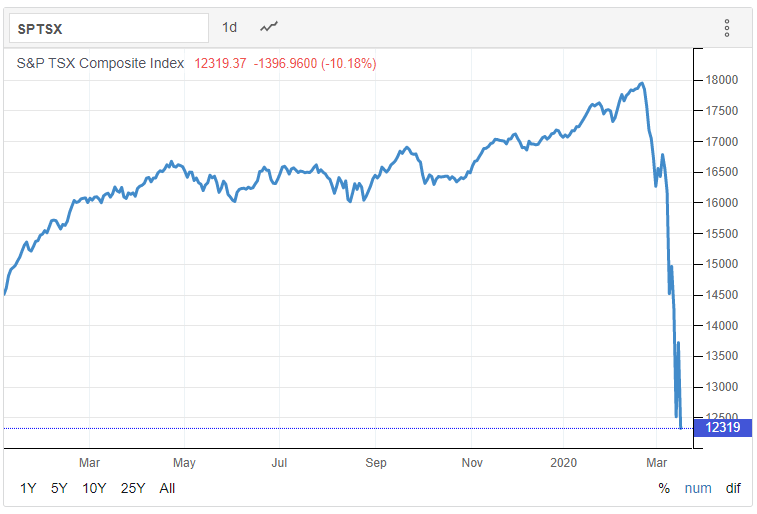

These are not normal times. The Fed's actions did nothing to calm markets. Indeed, stocks and bond yields plummeted in overnight trade, and the stock markets opened sharply lower in North America. The S&P 500 opened down over 8% while the TSX opened down 11%, triggering a circuit-breaker time out. This is the third time in a week the circuit breaker has hit. The TSX is down roughly 35% from its recent high (see chart below). The S&P 500 is down over 20%. The relative underperfomance of the Canadian stock market reflects our out-sized representation of the energy sector. The two weakest sectors in the TSX are the energy and financial sectors.

The world knows that the Fed and other central banks are running out of ammunition. Governor Powell said yesterday that he would not take the key fed funds rate into negative territory but instead would use "forward guidance" and asset purchases (quantitative easing) going forward.

The good news is that the banks are highly capitalized and much more resilient than during the financial crisis. Central banks since that time have put in place measures to monitor financial stability. Last Friday, the Canadian Office of the Superintendent of Financial Institutions (OSFI) reduced the capital requirements for Canadian banks to free up $300 billion for banks to support troubled borrowers. OSFI warned against the use of these funds to by back stocks or raise dividends.

OSFI also suspended the proposed revision in the qualifying mortgage rate slated to begin April 6. The posted mortgage rate, published weekly

by the Bank of Canada, will remain the qualifying mortgage rate. It is currently 5.19%, but it is expected to fall this week to around 4.95%.

But in these extraordinary times, there is a loss of confidence in the financial system. Some are calling for a full shutdown of the stock markets--but imagine the panic if no one could sell assets. There would truly be a run on the banks. Now is not a time to panic.