Stronger-Than-Expected Canadian Jobs Report in September

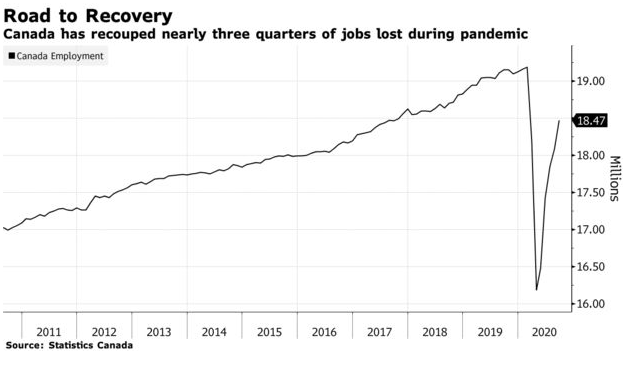

Canada Has Recouped Three-Quarters Of Pandemic Job Losses

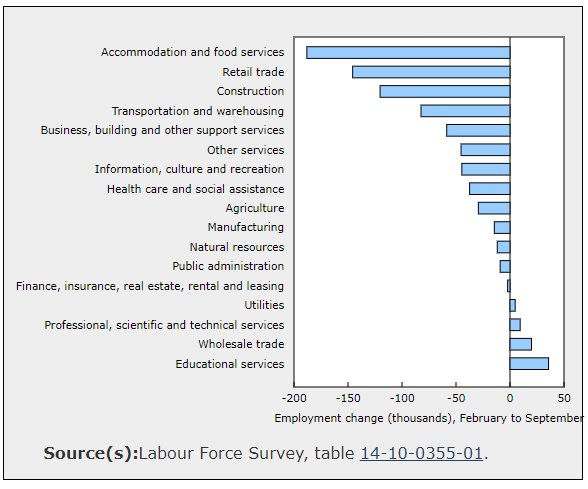

Employment in accommodation and food services rose by 72,000 (+7.4%) in September. This was the fifth consecutive monthly increase and brought total gains since the initial easing of COVID-19 restrictions in May to 427,000. Nevertheless, this industry's employment was the furthest from recovery in September, down 15.3% (-188,000) from its pre-pandemic February level.

The accommodation and food services industry is likely to continue to face many challenges over the coming months. While outdoor dining is likely to become impractical during the winter months and as some COVID restrictions are re-introduced, a recent study indicated that Canadians plan to reduce spending at restaurants.

Following four months of increases, employment in retail trade held steady in September. Compared with February, employment in this industry was down by 146,000 (-6.4%). After increasing sharply in May and June, following the initial easing of COVID-19 restrictions, retail sales slowed markedly in July.

In construction, a long road to recovery remains.

Employment in construction remained little changed for the second consecutive month in September and was down by 120,000 (-8.1%) compared with its pre-COVID level. Compared with February, employment in construction was down the most in Ontario (-54,000; -9.5%) and British Columbia (-39,000; -16.3%).

Construction consists of three subsectors: construction of buildings, heavy and civil engineering construction, and specialty trade contractors. According to the latest results from the Survey of Employment Payrolls and Hours, employment in construction fell from February to July in each of these subsectors, with the largest decline among specialty trade contractors. The release of investment in building construction for July showed that investment in building construction was slightly lower in July than in February.

Manufacturing employment almost fully recovered, but lagging in Alberta.

While some industries face a long recovery to pre-COVID employment levels, some sectors—including manufacturing—have almost fully recovered.

The pace of employment growth in manufacturing picked up in September (+68,000; +4.1%), following two months of modest growth over the summer. The September gains brought the total employment change in this industry to a level similar to that of February. While employment in manufacturing remained well below pre-pandemic levels in Alberta (-17,000; -12.1%) and to a lesser extent in Quebec (-15,000; -3.1%), employment was above the pre-COVID level in Ontario (+17,000; +2.3%).

Employment in educational services rises in September and surpasses pre-COVID levels.

Employment in educational services grew by 68,000 (+5.0%) in September, led by Ontario and Quebec. After declining by 11.5% from February to April, employment in the industry has increased for five consecutive months and has reached a level 2.6% higher than in February.

As students returned to school in August and September, some jurisdictions increased staffing levels to support classroom adaptations. On a year-over-year basis, employment in educational services was up by 32,000 (+2.3%) in September, driven by an increase in elementary and secondary school teachers and educational counsellors (not seasonally adjusted).

Bottom Line

The labour market impact of the COVID-19 economic shutdown has been particularly severe for low-wage employees (defined as those who earned less than $16.03 per hour, or two-thirds of the 2019 annual median wage of $24.04/hour). From February to April, employment among low-wage employees fell by 38.1%, compared with a decline of 12.7% for all other paid employees (not seasonally adjusted).

Almost half of the year-over-year decline in low-wage employees in September was accounted for by three industries: retail trade; accommodation and food services; and business, building and other support services industries.

The pandemic has disproportionately hit low-wage workers and youth, explaining why housing activity has been so strong. Low-wage employees and youth are typically not homebuyers or sellers.

Moreover, the RBC COVID Consumer Spending Tracker for the week of October 5 shows that spending trends continued solid with few signs of second-wave worries impacting consumer confidence yet.

According to RBC:

- "Among retail categories, clothing spending continued to climb, returning to year-ago levels.

- Spending on apparel, gifts, and jewelry was up 1.5% relative to last year.

- Other retail categories held on to gains from the past few months.

- Despite plateauing in dollar terms, entertainment spending ticked up relative to last year.

- During the summer, high golf spending likely continued into early fall— rather than slowing down as it would have in a normal year.

- Slower spending on accommodation and car rentals accelerated a downward trend in travel-related purchases that have dominated in the last several weeks.

- Travel spending had recovered partially from pandemic lows; it was still down about 60% in peak summer. It worsened again as the weather cooled.

- Simultaneously, automotive spending fell slightly, in line with seasonal trends, as the summer road trip season came to an end.

- Labour Day saw the strongest restaurant spending since before the pandemic, but the uptick was fleeting.

- Spending on dining out quickly fell back to -6% relative to a year ago, a level it’s hovered around since July."

Recently released data from the real estate boards in Toronto and Vancouver showed strong sales activity and significant further upward pressure on prices. In the GTA, a surge in new listings of high-rise condos meant that the upward pressure on home prices was driven by the ground-oriented market segments, including detached and semi-detached houses and townhouses. Home sales and new listing activity reached record levels in Metro Vancouver last month. The heightened demand from home buyers is keeping overall supply levels down. This is creating upward pressure on home prices, which have been edging up since the spring.

The CREA data for the whole country will be out on the 15th of October. This adjusts the price data for types of homes sold, giving us a better idea of how significant price pressures have been and in which sectors—more on that next week.

This article was written by Dr Sherry Cooper, DLC's chief economist and was published here with permission.