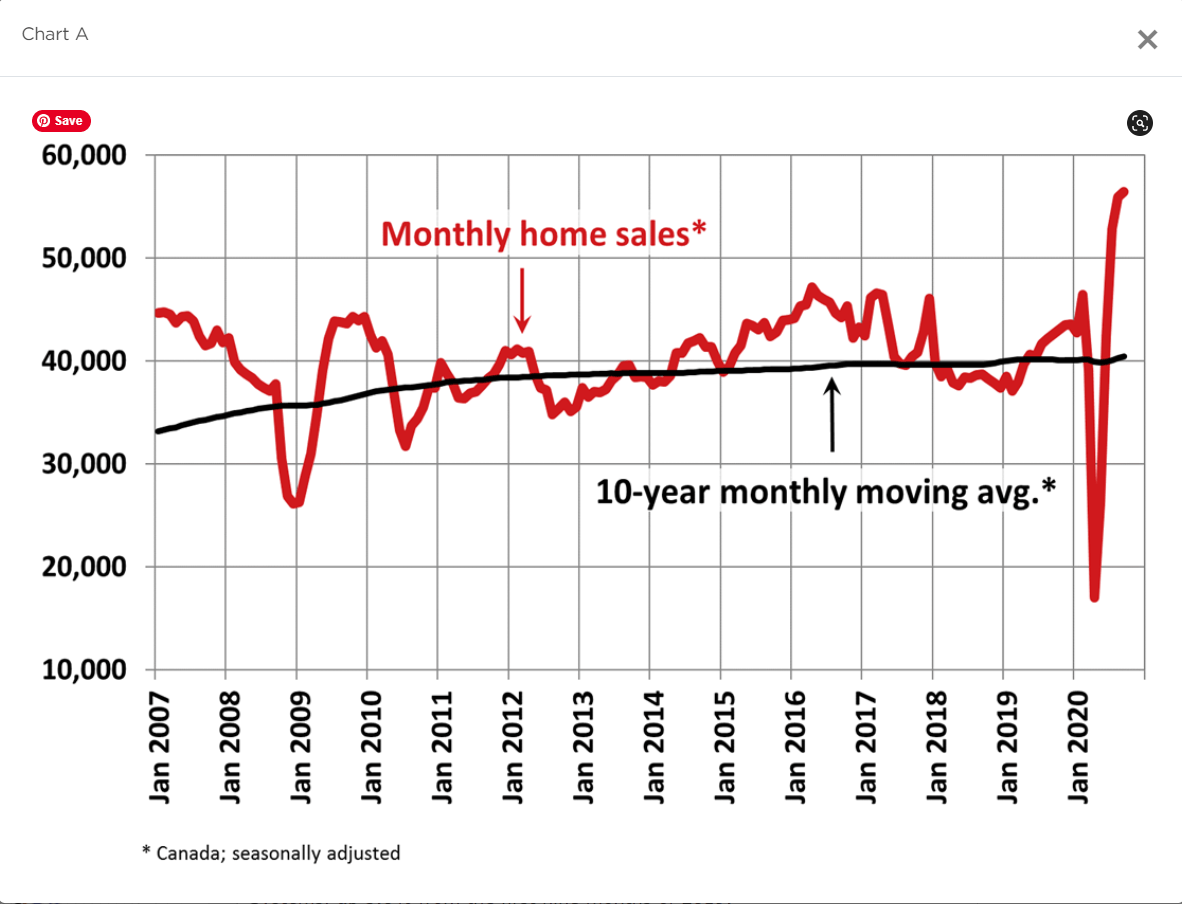

Canadian Home Sales and Prices Set Records Again in September

New Listings

The number of newly listed homes declined by 10.2% in September, reversing the surge to record levels seen August. New supply was down in two-thirds of local markets, led by declines in and around Vancouver and the GTA.

With sales edging up in September and new supply dropping back, the national sales-to-new listings ratio tightened to 77.2% – the highest in almost 20 years and the third-highest monthly level on record for the measure.

Based on a comparison of sales-to-new listings ratio with long-term averages, about a third of all local markets were in balanced market territory, measured as being within one standard deviation of their long-term average. The other two-thirds of markets were above long-term norms, in many cases well above.

There were just 2.6 months of inventory on a national basis at the end of September 2020 – the lowest reading on record for this measure. At the local market level, a number of Ontario markets are now into weeks of inventory rather than months. Much of the province of Ontario is close to or under one month of inventory.

Home Prices

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose by 1.3% m-o-m in September 2020. Of the 39 markets now tracked by the index, all but two were up between August and September.

As buyers are moving further away from city centres, CREA added a large number of Ontario markets to the MLS® HPI this month. The list includes Bancroft and Area, Brantford Region, Cambridge, Grey Bruce Owen Sound, Huron Perth, Kawartha Lakes, Kitchener-Waterloo, the Lakelands (Muskoka-Haliburton-Orillia-Parry Sound), London & St. Thomas, Mississauga, North Bay, Northumberland Hills, Peterborough and the Kawarthas, Quinte & District, Simcoe & District, Southern Georgian Bay, Tillsonburg District and Woodstock-Ingersoll.

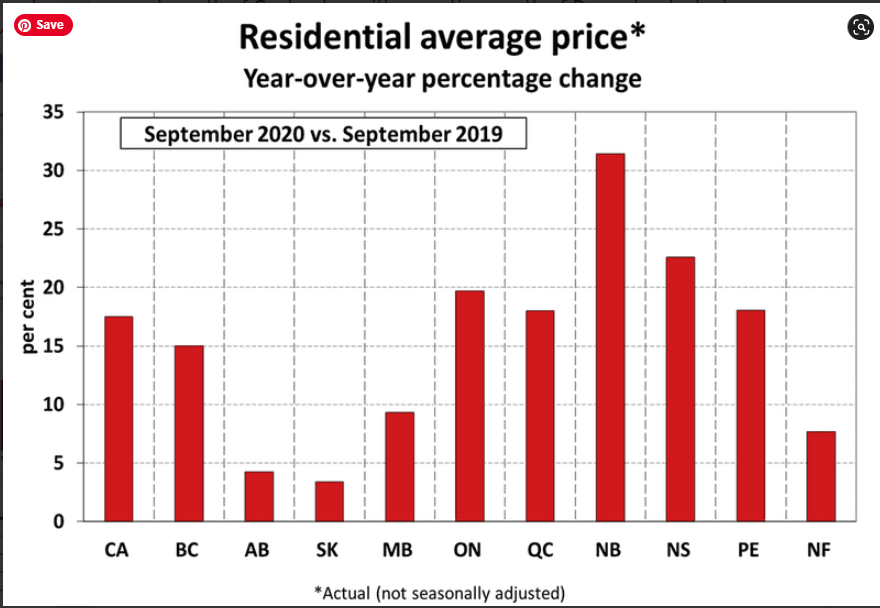

The non-seasonally adjusted Aggregate Composite MLS® HPI was up 10.3% on a y-o-y basis in September – the biggest gain since August 2017. The largest y-o-y gains in the 22-23% range were recorded in Bancroft and Area, Quinte & District, Ottawa and Woodstock-Ingersoll.

This was followed by y-o-y price gains in the range of 15-20% in Barrie, Hamilton, Niagara, Guelph, Brantford, Cambridge, Grey Bruce-Owen Sound, Huron Perth, the Lakelands, London & St. Thomas, North Bay, Simcoe & District, Southern Georgian Bay, Tillsonburg District and Montreal.

Prices were up in the 10-15% range compared to last September in the GTA, Oakville-Milton, Kawartha Lakes, Kitchener-Waterloo, Mississauga, Northumberland Hills, Peterborough and the Kawarthas, and Greater Moncton.

Meanwhile, y-o-y price gains were around 5% in Greater Vancouver, the Fraser Valley, the Okanagan Valley, Regina, Saskatoon and Quebec City. Gains were about half that in Victoria and elsewhere on Vancouver Island, as well and in St. John’s, and prices were more or less flat y-o-y in Calgary and Edmonton.

The actual (not seasonally adjusted) national average home price set another record in September 2020, topping the $600,000 mark for the first time ever at more than $604,000. This was up 17.5% from the same month last year.

Bottom Line

Housing strength is largely attributable to record-low mortgage rates and pent-up demand by households that have maintained their level of income during the pandemic. The hardest-hit households are low-wage earners in the accommodation, food services, and travel sectors. These are the folks that can least afford it and typically are not homeowners.

The good news is that the housing market is contributing to the recovery in economic activity.