Strong August Jobs Report in Canada

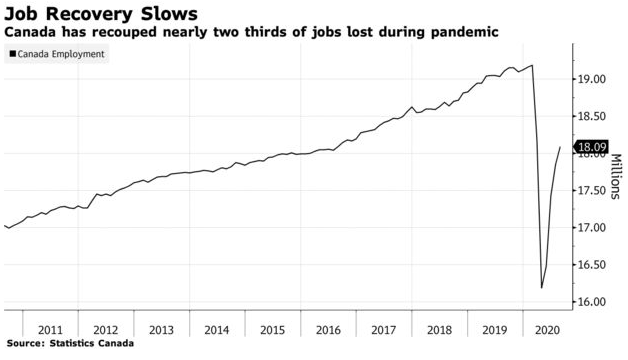

Canada Has Recouped Two-Thirds Of Pandemic Job Losses

The Jobless Rate Continued to Fall in August

The unemployment rate fell 0.7 percentage points to 10.2% in August. As a result of the COVID-19 economic shutdown, the unemployment rate had surged from 5.6% in February to a record high of 13.7% in May. By way of comparison, during the 2008/2009 recession, the unemployment rate rose from 6.2% in October 2008 and reached a peak of 8.7% in June 2009. It took approximately nine years before it returned to its pre-recession rate.

The unemployment rate fell most sharply in August among core-aged women aged 25 to 54 years old, down 1.2 percentage points to 7.5%, the lowest unemployment rate among all major groups. This decline was largely due to employment increases, as overall labour force participation was unchanged from July. The unemployment rate for core-aged men fell 0.7 percentage points to 8.1%, also the result of increased employment, with little change in their labour market participation.

Employment gains in the services sector continued to outpace that of the goods-producing sector. Employment growth in the services sector was driven by gains in educational services, accommodation and food services and the "other services" industry. In the goods sector, gains in manufacturing were partially offset by declines in natural resources.

Accommodation and food services as well as retail trade were among the industries hardest hit by the initial COVID-19 economic shutdown. By April, employment had fallen to half (-50.0%) of its pre-pandemic level in accommodation and food services and to 77.1% of its pre-COVID-19 level in retail trade. Starting in May, employment rebounded in both sectors as many provinces began reopening their economy.

Employment growth in accommodation and food services rose by 18.4% per month on average from May to July. In August, however, the pace of growth in the industry slowed to 5.3% (+49,000). Despite these recent gains, employment in accommodation and food services was at 78.9% of its February level. August marked the fifth full month of international travel restrictions, which continues to affect industries with strong ties to tourism.

The number of people employed in retail trade edged up 0.7% (+14,000) in August, following average monthly increases of 6.3% over the previous three months. Employment in retail trade reached 93.4% of its pre-COVID-19 level but fell just below the rate of recovery for total employment (94.3%).

While employment remained below pre-COVID-19 levels, retail sales in June were higher than in February and are expected to continue to rise in July, based on preliminary estimates. This highlights potential structural changes within the industry as employers have been able to increase their sales despite a smaller workforce.

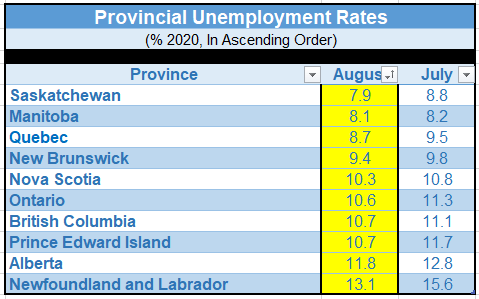

Employment Increased in Most Provinces in August--Led by Ontario and Quebec

Employment in Ontario rose by 142,000 in August (+2.0%), nearly all in full-time work, while the unemployment rate fell by 0.7 percentage points to 10.6%. Combined with the employment increases in June and July (+529,000), the gains in August brought employment in Ontario to within 93.6% of its pre-pandemic level.

In the census metro area (CMA) of Toronto, employment increased by 121,000 (+3.8%), nearly double the growth rate of the province, and reached 93.3% of its pre-pandemic level.

In Quebec, employment increased by 54,000 (+1.3%) in August, building on gains of 576,000 over the previous three months, and bringing employment in the province to within 95.7% of its pre-COVID level.

In the Montréal CMA, employment grew by 38,000 (+1.8%) in August and reached 96.0% of its pre-pandemic level.

Employment rose in most Western provinces in August. British Columbia reported the largest increase, up 15,000 (+0.6%). Employment reached 94.1% of its February level and the unemployment rate fell 0.4 percentage points to 10.7%.

While employment in Alberta was little changed, the unemployment rate declined by a full percentage point to 11.8% as fewer people looked for work.

In Atlantic Canada, Nova Scotia had the largest employment gain in August, up 7,200 (+1.6%), mostly in part-time work. The unemployment rate was little changed at 10.3%, as more Nova Scotians participated in the labour market. After notable increases in May and June, employment in New Brunswick held steady for the second consecutive month.

Bottom Line

This was still a relatively strong employment report even though job gains have slowed. Canada's employment recovery has outpaced the US, recouping two-thirds of the lost jobs compared to only a 50% gain south of the border. The hardest-hit has been both low-wage workers and youth, which helps to explain why housing activity has been so strong. Low-wage employees and youth are typically not homebuyers or sellers. Moreover, consumer spending in Canada has solidified very near to pre-COVID levels. Spending on entertainment, dining and self-care has risen recently as more businesses open up and is now approaching year-ago levels. Total credit or debit card spending is up about 5% relative to the same time last year. Canadians are venturing out more around their home towns, but not going much further.

According to RBC:

- "While online spending remained prevalent in some areas (e.g., groceries), in-person transactions continued to recover.

- Spending indicates Canadians were comfortable going out to dinner, even if to a patio. Restaurant spending was buoyed by Canadians seeking in-person dining experiences and was down just over 4% from last year’s level.

- The share of online transactions at restaurants decreased to 17% from one-third at its post-crisis peak.

- Health and self-care spending increased through mid-August, as gym reopenings led to an uptick in fitness spending.

- Entertainment spending picked up further into August and was down 10% relative to last year.

- Spending was supported by still-strong spending on golf and to a lesser degree digital goods.

- More recently, Canadians began spending again on professional sports, lotteries, hobbies, and local attractions."

Recent data from the local real estate boards in Toronto and Vancouver showed strong sales activity and significant further upward pressure on prices. The CREA data for the whole country will be out on the 15th of September. This adjusts the price data for types of homes sold, giving us a better idea of how significant price pressures have been.