January Home Sales Slow Mostly Owing To a Dearth of New Listings

Home Sales Slip A Bit In January As Supply Tightens Pushing Up Prices

Statistics released today by the Canadian Real Estate Association (CREA) show that national existing-home sales dipped between December and January owing to a dearth of new listings, especially in the GTA. As the CREA chart below shows, the pace of monthly home resales nevertheless remained strong.

Home sales recorded over Canadian MLS® Systems declined by 2.9% in January 2020, although they remain among the stronger monthly readings of the last few years.

Transactions were down in a little over half of all local markets in January, with the national result most impacted by a slowdown of more than 18% in the Lower Mainland of British Columbia. According to CREA, "While there were few notable gains in January, it should be noted that many of the weaker results have come alongside a shortage of new supply in markets where inventories are already very tight."

Actual (not seasonally adjusted) sales activity was still up 11.5% compared to January 2019, marking the best sales figures for the month in 12 years. Transactions surpassed year-ago levels in about two-thirds of all local markets, including most of the largest urban markets. Some of the larger markets where sales were down, such as Ottawa and Windsor-Essex, are currently among some of the tightest supplied markets in Canada.

“Home price growth continues to pick up in housing markets where listings are in short supply, particularly in Southern, Central and Eastern Ontario,” said Jason Stephen, president of CREA. “Meanwhile, ample supply across the Prairies and in Newfoundland and Labrador is resulting in ongoing competition among sellers."

In many tight housing markets, potential sellers appear to be waiting until the spring to list their properties when the weather is better and more buyers are actively looking.

New Listings

The number of newly listed homes was little changed in January, edging up a slight 0.2% on the heels of a series of declines which have left new listings at a near-decade low. January’s small month-over-month (m-o-m) change came as the result of declines in a number of larger markets, including Calgary, Edmonton and Montreal, which were offset by gains in the York and Durham Regions of the Greater Toronto Area (GTA) where new supply bounced back at the start of 2020 following a sharp slowdown towards the end of last year.

With sales down and new listings up slightly in January, the national sales-to-new listings ratio fell back to 65.1% compared to 67.2% posted in December 2019. Even so, the long-term average for this measure of housing market balance is 53.8%. It has been significantly above that long-term average for the last four months. Barring an unforeseen change in recent trends between the balance of supply and demand for homes, price gains appear poised to accelerate in 2020

.

Indeed, concern is growing that Canada's largest housing market may be about to experience a new round of froth, similar to 2016.

“It’s looking more and more like early-2016 all over again for the Toronto housing market. This is not a good sign,”

wrote

RBC Economics senior economist Robert Hogue. “Those were the days when things started to heat up uncomfortably, propelling property values sky-high in the ensuing year.”

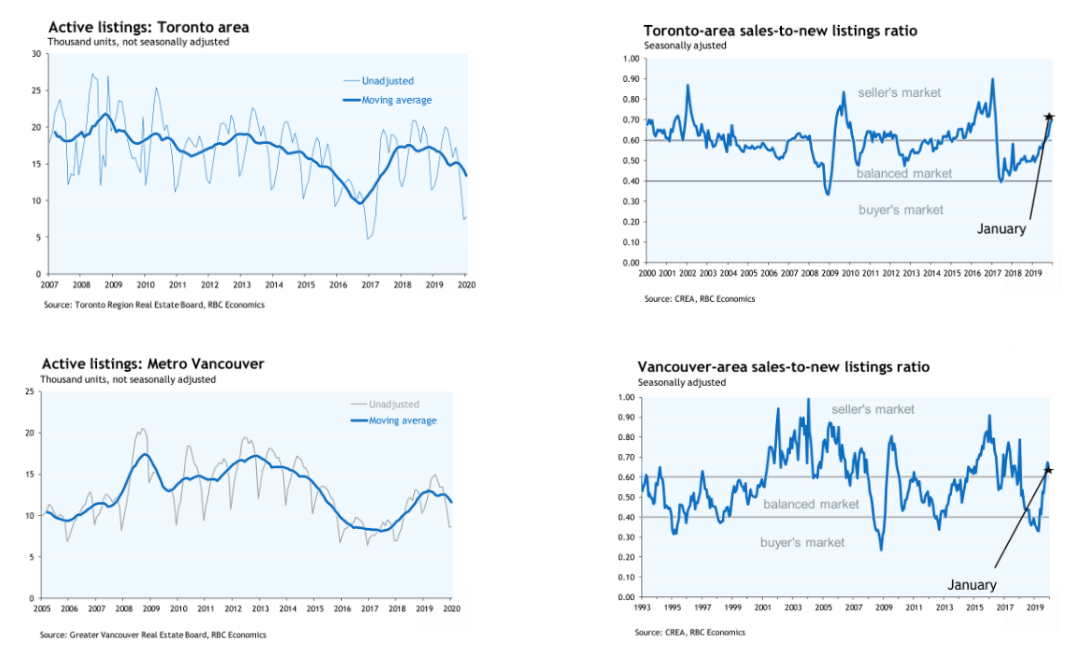

Based on a comparison of the sales-to-new listings ratio with the long-term average, close to two-thirds of all local markets were in balanced market territory in January 2020. Apart from a few areas of Alberta and Saskatchewan, the remainder were all favouring sellers. As the chart below shows, the GTA housing market is in sellers' market territory.

There were 4.2 months of inventory on a national basis at the end of January 2020 – the same as in November and December and the lowest level since the summer of 2007. This measure of market balance is now a full month below its long-term average of 5.2 months.

National measures of market balance continue to mask significant and increasing regional variations. The number of months of inventory has swollen far beyond long-term averages in the Prairie provinces and Newfoundland & Labrador, giving homebuyers ample choice in these regions. By contrast, the measure is running well below long-term averages in Ontario, Quebec and the Maritime provinces, resulting in increased competition among buyers for listings and providing fertile ground for price gains. The measure is still in balanced market territory in British Columbia overall but is tightening in the Vancouver area as the chart below indicates.

Home Prices

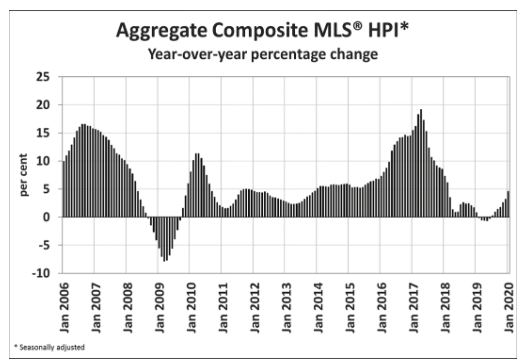

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.8% in January 2020 compared to December, marking its eighth consecutive monthly gain. It is now up 5.5% from last year’s lowest point in May and has set new records in each of the past six months

(see the CREA chart below) .

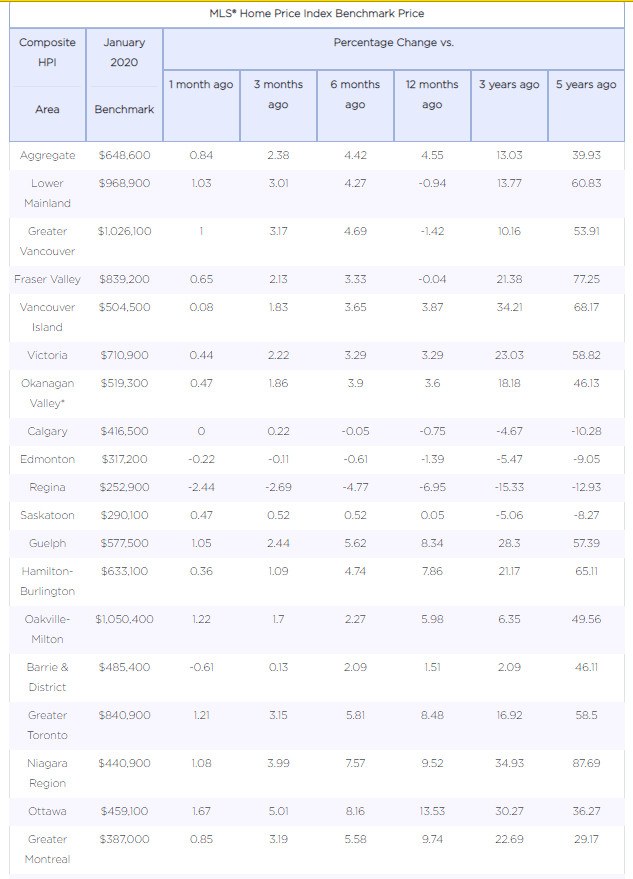

The MLS® HPI in January was up from the previous month in 14 of the 18 markets tracked by the index. (see CREA table below).

Home price trends have generally been stabilizing in most Prairie markets in recent months following lengthy declines. Meanwhile, prices are clearly on the rise again in British Columbia and in Ontario’s Greater Golden Horseshoe (GGH). Further east, price growth in Ottawa, Montreal and Moncton continues as it has for some time now, with Montreal and particularly Ottawa having strengthened noticeably in recent months.

Comparing home prices to year-ago levels yields considerable variations across the country, although for the most part trends are still regionally split along east/west lines, with rising gains from Ontario east, and a mixed bag of smaller gains and declines in B.C. and the Prairies.

Home prices in Greater Vancouver (-1.2%) remain slightly below year-ago levels, but declines are still shrinking. Meanwhile, January saw prices back in positive y-o-y territory in the Fraser Valley (+0.3%). Elsewhere in British Columbia, home prices logged y-o-y increases in the Okanagan Valley (+3.5%), Victoria (+3.4%) and elsewhere on Vancouver Island (+4%).

Calgary, Edmonton and Saskatoon continued to post small y-o-y price declines, while the y-o-y gap has now widened to -6.9% in Regina.

In Ontario, home price growth has re-accelerated across most of the GGH, with a number of markets getting close to double digits. Meanwhile, price gains in recent years have continued uninterrupted in Ottawa (+13.7%), Montreal (+9.8%) and Moncton (+6.4%).

All benchmark home categories tracked by the index accelerated further into positive territory on a y-o-y basis, with similar sized gains among the different property types. Condo apartment unit prices posted the biggest y-o-y increase (+5%) followed closely by two-storey single-family homes (+4.8%), one-storey single-family homes (+4.4%) and townhouse/row units (+4.2%). Earlier this cycle, condo prices markedly outpaced the single-family sector, but in the past year, detached homes have more than caught up.

Also, note in the table below that the benchmark home price in Toronto-area Oakville-Milton at $1.05 million is now above the benchmark price in Greater Vancouver of $1,026. The GTA has a much larger and more diverse housing market with a benchmark price of $.841 million.

Consumer Unsecured Debt is a Bigger Problem Than Mortgage Debt

Bottom Line: Housing markets in Canada are strengthening as interest rates continue to fall, job growth is robust, wage gains are sizable and foreign immigration boosts demand. While the stress test qualifying rate remains stuck at 5.19%, market forces emanating from the coronavirus epidemic are pushing down market rates, and TD Bank has cut its posted rate to 4.99%.

If downward pressure continues, which is likely given the news out of China, other big banks may follow the TD lead, reducing the qualifying rate. Regardless, contract mortgage rates are once again under downward pressure.

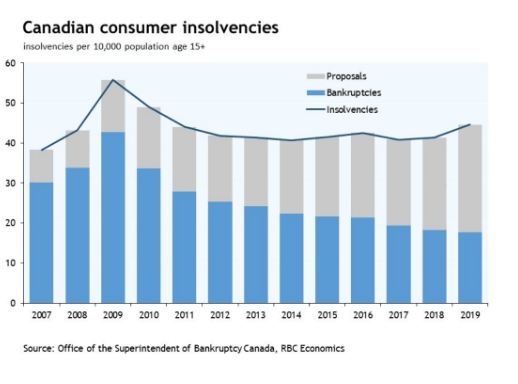

The Bank of Canada is unlikely to cut its overnight benchmark rate when it meets again March 4. It will point to the resilience of the Canadian economy and the debt exposure of Canadian households. To be sure, much has been made of the eye-catching fact that consumer insolvencies rose by 9.5% in 2019, the most substantial annual increase since the 2008-09 recession. But it should be emphasized that this reflected excessive credit card and auto loans, not mortgage debt.

Consumer insolvencies are comprised of household bankruptcies and proposals (see chart below). Bankruptcies are falling and have been since the economic recovery began in 2009. Last year’s increase reflected a rise in the number of “proposals”—offers to pay creditors a percentage of what is owed and extend the repayment schedule, a remedy available to individuals with up to $250,000 in unsecured debt.

Mortgage debt, on the other hand, has been rock solid. The latest data from the Canadian Bankers Association shows just 0.23% of mortgages were more than 90 days in arrears as of August 2019, matching the lowest rate since 1990.

That is not to say mortgage debt isn’t a source of stress for some households—mortgages account for 45% of the average household’s debt servicing costs. But those having trouble making debt payments are likely prioritizing their mortgages over credit cards and auto loans. There has also been an increase in insolvencies among individuals without mortgage debt.

The Bank of Canada and the regulators would do better to focus on the curtailment of excessive unsecured household borrowing than to fixate on mortgage stress testing alone.

This article was written by Dr. Sherry Cooper and was originally included in her newsletter. She's awesome, we like her.