Homeownership Rates in Canada Still Among Highest Globally

Canadians sure do love owning their homes!

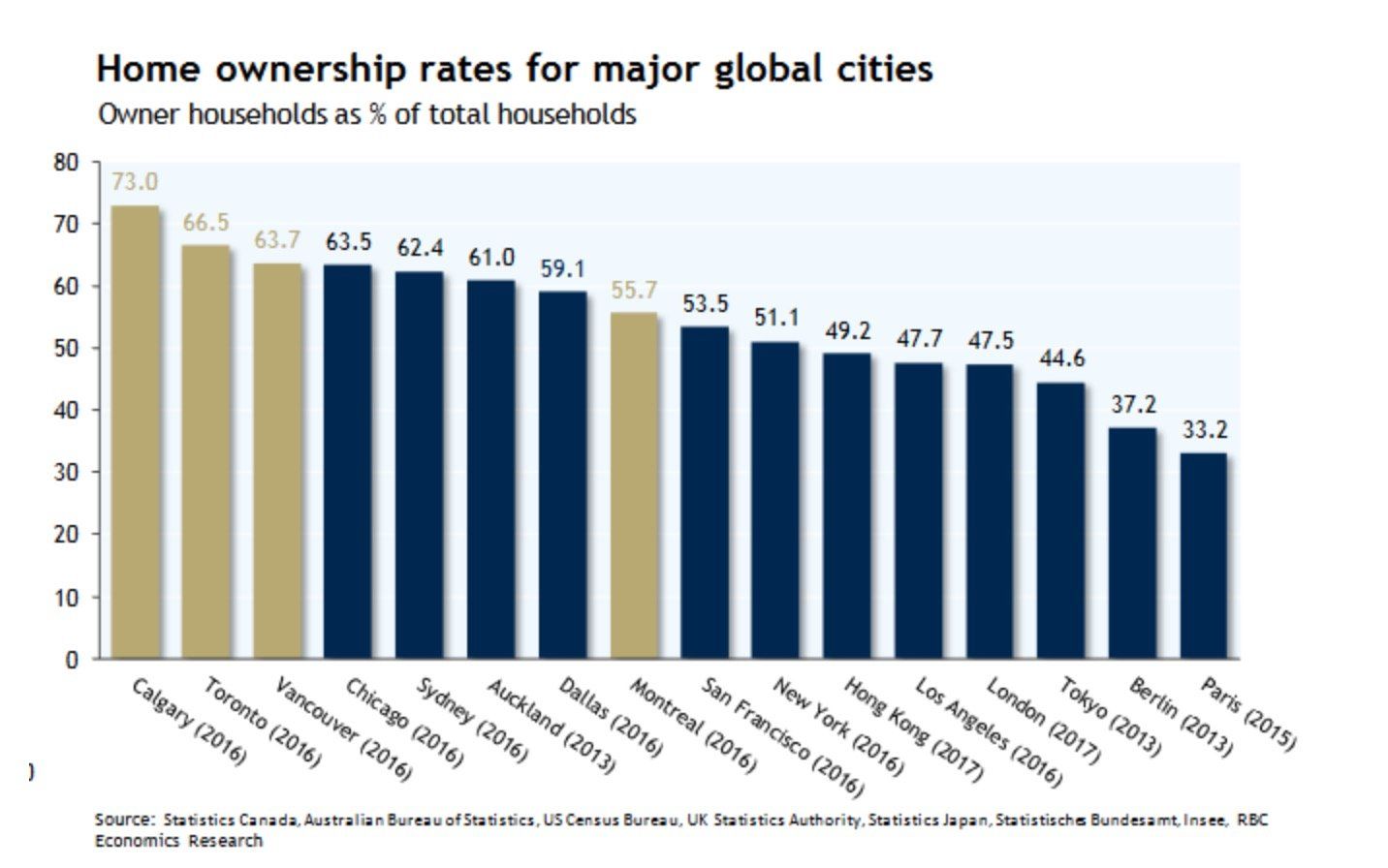

Despite housing affordability concerns across the country, homeownership rates in Canada remain among some of the highest in the world.

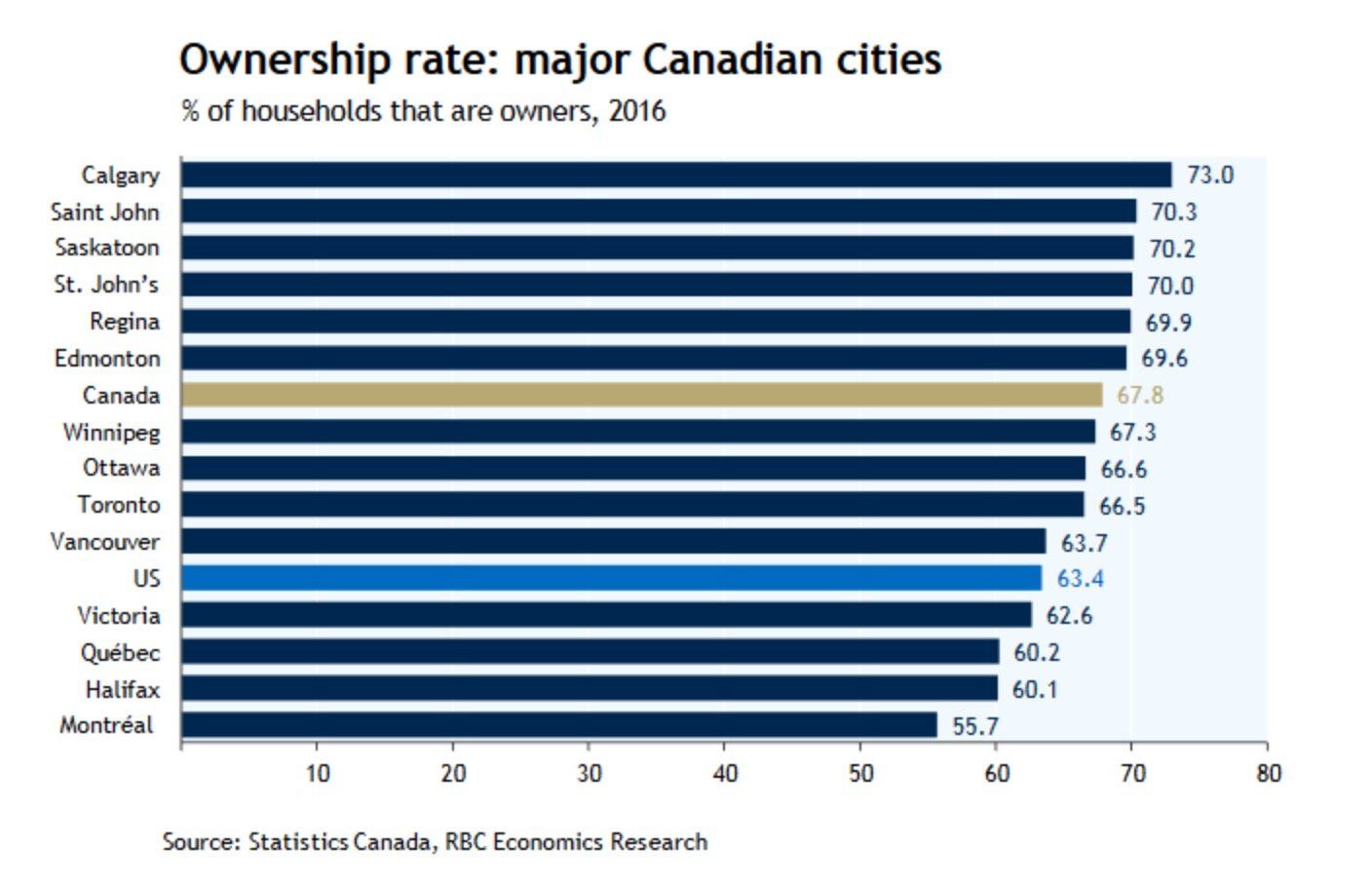

As of 2016 (the most recent data available), Canada boasts an overall homeownership rate of 67.8%, down slightly from a peak of 69% in 2011, according to research from RBC Economic Research. Comparatively, the U.S. has a homeownership rate of 63.4%.

Even for those aged 35 and under, more than 40% of households own their own homes.

“We take issue with the notion that Canada has a homeownership problem,” reads the RBC report. “…the proportion of all Canadian households who own a home is one of the highest among advanced economies.”

The report cautions the federal government to “tread carefully” when considering measures to address the issue of affordability.

It argues that those measures—such as relaxing the mortgage stress test , extending amortizations for insured mortgages or increasing the allowable RRSP takeout for first-time homebuyers—would only bring short-term relief to homeowners and do nothing to address the issue of high household debt.

RBC adds that the measures focus on boosting demand and increasing buyers’ purchasing power, which on their own would likely inflate prices and lead to a further deterioration of affordability down the road.

Addressing the Supply Issue

“[Those measures alone] do nothing to address what we believe is the root of Canada’s housing woes: gaps in the mix of housing options in some of Canada’s larger markets,” reads the report. “In our view, the longer-lasting remedy to Canada’s affordability crisis lies first and foremost on the supply side of the equation.”

It adds that solving supply isn’t the federal government’s responsibility alone, and calls on all levels of government to work together to develop solutions.

“What millennials in Vancouver and Toronto really need is more inventory of homes they can afford, and a better mix of housing options—be it to own or rent,” the report says.

“At the very least, the collective goal should be to remove barriers (regulatory, administrative or otherwise) inhibiting home developers and builders to respond quickly to the demand for new housing—especially when that demand is rising rapidly.”

More Homeownership Stats

Some additional stats on homeownership trends in Canada include:

- Calgary has among the highest homeownership rate among global cities at 73%.

- Toronto (66.5%) and Vancouver (63.7%), the least affordable markets in Canada, still have homeownership rates double those in cities like Berlin (37.2%) and Paris (33.2%).

- Among Canada’s large cities, Montreal has the lowest overall homeownership rate at 55.7%

- For those under the age of 35, the homeownership rate was the highest in Calgary (50.6%), and lowest in Victoria (27.4%).

This article was written by Steve Huebl and was originally published on the Canadian Mortgage Trends on March 4th 2019.