Canadian Jobs Market Rebounds in June As Lockdown Eases

Canada’s Jobs Recovery Resumed in June As Lockdown Began to Ease

This morning, Statistics Canada released the June 2021 Labour Force Survey showing employment rose 230,700 (1.2%) in June, rebounding from a cumulative decline over the previous two months of 275,000. Total hours worked were little changed. The national unemployment rate fell 0.4 percentage points to 7.8%.

Jobs continue to swing back and forth as the various COVID waves drive lockdowns and reopenings. Hopefully, we’re in the last of the reopenings. Services accounted for all of the gains. Hospitality jobs were the biggest gainer, as expected, adding 101k positions, but they remain well below pre-virus levels. Restrictions are expected to continue easing through the summer, which should mean more solid gains over the next couple of months. Other sectors seeing a boost from the reopening were retail/wholesale (+78k), education (+26k) and health care (+20.5k). Goods sectors were down across the board, with losses concentrated in construction (-23k) and manufacturing (-12k).

Beyond the headline increase, one of the bigger stories in this report is the sharp 0.6 ppt rise in the participation rate to 65.2%. That’s the largest increase in a year and leaves the rate 3-4 ticks away from pre-COVID levels. Compare that to the U.S., where the participation rate is still nearly 2 ppts lower than in early 2020. The rise in the participation rate limited the decline in the jobless rate to 0.4 ppts to 7.8%, still some wood to chop there. The rising participation rate should alleviate some concerns about widespread labour shortages.The bulk of the gains were in pandemic-exposed sectors, like retail, food and accommodation, that got hit most by the new containment measures. Employment in accommodation and food services was up 101,000. The retail sector added 75,000 jobs.

Increasing vaccination rates and falling Covid-19 case counts have allowed the country to finally re-open restaurants, bars and retail stores after months of closures. Ontario began allowing patio dining earlier this month, and several cities in Quebec have further relaxed restrictions, allowing indoor dining for the first time this year.

With the June gains, Canada has recovered 2.65 million of the 3 million jobs lost at the height of the pandemic last year. The nation created 263,900 part-time jobs, with full-time employment down 33,200.Employment growth in June was entirely in part-time work and concentrated among youth aged 15 to 24, primarily young women. Increases were greatest in accommodation and food services and retail trade, consistent with the lifting or easing public health restrictions affecting these industries in late May and early June in many jurisdictions.

The number of employed people working less than half their usual hours fell by 276,000 (-19.3%) in June. Total hours worked were little changed and were 4.0% below their pre-pandemic level.

The employment increase in June was in part-time work, which rose by 264,000 (+8.0%) following combined losses of 132,000 over the previous two months. The overall level of part-time employment was essentially the same as in February 2020, before the COVID-19 pandemic. Increases in the month were driven by accommodation and food services and retail trade—two industries where part-time workers represent an above-average proportion of employment—and were concentrated among youth.

After falling by 143,000 over the previous two months, full-time work was little changed in June and was 336,000 (-2.2%) lower than its pre-pandemic level.

Gains were driven by private-sector employees, while self-employment declines.

The number of private-sector employees rose by 251,000 (+2.1%) in June, following two monthly declines. As of June, the number of private-sector employees was 2.5% lower (-313,000) than in February 2020.

In the public sector, employment rose by 43,000 (+1.1%) in June, bringing it to 180,000 (+4.6%) above pre-pandemic levels. Employment in this sector has trended up following the initial wave of the pandemic, particularly driven by increases in health care and social assistance, public administration, and educational services.

The number of self-employed workers fell by 63,000 (-2.3%) in June and was down 7.2% (-207,000) compared with February 2020. Self-employment is a broad category that includes workers in various situations, including working owners of incorporated or unincorporated businesses and independent contractors. Compared with June 2019, declines in the number of self-employed were widespread across multiple industries and were concentrated among the self-employed with paid help.

The employment rate remains below pre-pandemic levels.

To fully understand current and emerging labour market trends, it is essential to consider employment change against the backdrop of population change, which totalled 1.1% (+334,000) between February 2020 and June 2021. To keep pace with this population growth and maintain a stable employment rate—that is, employment as a proportion of the population aged 15 and over—employment would have had to grow by 203,000. Instead, total employment was 340,000 lower in June than in February 2020, and the employment rate was 1.7 percentage points lower (60.1% compared with 61.8%).

Number of Canadians who worked from home drops by nearly 400,000

Among Canadians who worked at least half their usual hours in June, the number who worked from home fell by nearly 400,000 to 4.7 million. For 2.6 million of these people, working from home represented an adaptation to the COVID-19 pandemic, as this was not their usual work location. At the same time, the number of people working at locations other than home rose by approximately 700,000 to 12.3 million.

Almost one-third (31.4%) of workers aged 25 to 54 and more than one-quarter (27.2%) of those aged 55 and older worked from home in June. Due to their concentration in industries where working from home is less feasible, such as accommodation and food services, a far smaller proportion of youth aged 15 to 24 (12.9%) did so.

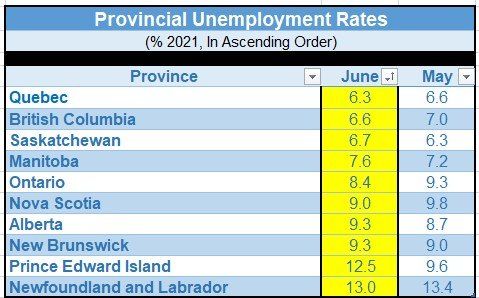

Regionally, Ontario and Quebec led the way higher, though B.C. and Nova Scotia had solid increases as well. Interestingly, even with restrictions easing through most of the country, only five provinces reported job gains.

Bottom Line

The jobs report is the last major piece of economic data before next week’s Bank of Canada policy decision, where it’s expected to continue paring back its stimulus efforts. The Bank of Canada is among the first from advanced economies to shift to a less expansionary policy, having already cut its purchases of Canadian government bonds to $3 billion weekly from a peak of $5 billion last year.

Analysts anticipate that will come down to C$2 billion per week at the July 14 meeting before eventually falling to a weekly pace of about C$1 billion by early next year. In addition to the bond tapering, the market has priced in at least one interest rate hike by this time next year.

Canada’s economy remains 340,000 jobs shy of pre-pandemic levels. The unemployment rate was below 6% before the pandemic.

With vaccination rates rising and restrictions easing, economists are predicting a strong rebound in the second half. According to a Bloomberg News survey of economists earlier this month, Canada’s expansion is seen accelerating to an annualized pace of 9.1% in the third quarter, with a 6% gain in the final three months of 2021. Consumer and business confidence regarding the outlook has recently hit record highs.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was syndicated with permission.