Canadian Home Sales and New Listings Plunge in April 2020

DLC Canadian Mortgage Experts • May 20, 2020

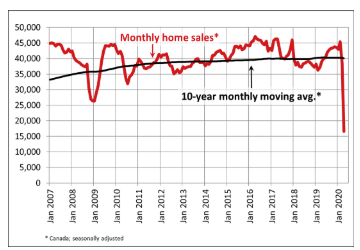

The pandemic shutdown has put every sector of the economy into a medically induced coma, so, of course, the housing sector is no exception. Data released this morning from the Canadian Real Estate Association (CREA) showed national home sales fell a record 56.8% in April, compared to an already depressed March, in the first full month of COVOD-19 lockdown (see chart below). Transactions were down across the country.

Among Canada's largest markets, sales fell by 66.2% in the Greater Toronto Area (GTA), 64.4% in Montreal, 57.9% in Greater Vancouver, 54.8% in the Fraser Valley, 53.1% in Calgary, 46.6% in Edmonton, 42% in Winnipeg, 59.8% in Hamilton-Burlington and 51.5% in Ottawa.

The residential real estate industry is not standing still, however. Technological innovation is creating new ways of buying and selling homes. According to Shaun Cathcart, CREA's Chief Economist, "Preliminary data for May suggests things may have already started to pick up a bit for both sales and new listings, in line with evidence that realtors and their clients have adopted new and existing virtual technology tools. These tools have allowed quite a bit of essential business to safely continue, and will likely remain key for some time."

The residential real estate industry is not standing still, however. Technological innovation is creating new ways of buying and selling homes. According to Shaun Cathcart, CREA's Chief Economist, "Preliminary data for May suggests things may have already started to pick up a bit for both sales and new listings, in line with evidence that realtors and their clients have adopted new and existing virtual technology tools. These tools have allowed quite a bit of essential business to safely continue, and will likely remain key for some time."

I have heard agents discussing software that virtually "stages" properties, allowing potential buyers to see the possibilities of existing and renovated floor plans and options in decor and design. The software replaces the need for expensive "physical" staging and can be far more creative. Where there is challenge, there is opportunity, and the people that create and adopt these innovative virtual solutions could be big winners.

Keeping the lid on price pressures, the number of newly listed homes across Canada declined by 55.7% m-o-m in April. The Aggregate Composite MLS® Home Price Index declined by only 0.6% last month, the first decline since last May. While some downward pressure on prices is not surprising, the comparatively small change underscores the extent to which the bigger picture is that both buying and selling is currently on pause.

Keeping the lid on price pressures, the number of newly listed homes across Canada declined by 55.7% m-o-m in April. The Aggregate Composite MLS® Home Price Index declined by only 0.6% last month, the first decline since last May. While some downward pressure on prices is not surprising, the comparatively small change underscores the extent to which the bigger picture is that both buying and selling is currently on pause.

Mortgage Qualifying Rate Set To Drop

The mortgage qualifying rate, the so-called Big Bank posted rate, has been above 5% since the OSFI stress test began on January 1, 2018. Despite dramatic declines in the government of Canada bond yield, which currently hovers at a mere 0.388%, and a huge fall in contract mortgage rates, the banks have kept their posted rates elevated. The minimum stress test rate began in 2018 at 5.34%, then finally fell to 5.19% and more recently to 5.04%--all still at a historically wide margin above market-determined rates.

In the past week, RBC and BMO have cut their 5-year posted rates slightly further to 4.94%. If no other banks follow, the Bank of Canada's OSFI stress test rate will fall to 4.99%. If at least one otherl bank goes to 4.94%, the qualifying rate will drop to 4.94%. Every little bit helps.

With the first news of the COVID-19 pandemic threat, the BoC report said that "uncertainty about just how bad things could get created shock waves in financial markets, leading to a widespread flight to cash and difficulty selling assets. Policy actions are working to:

- restore market functioning

- ensure that financial institutions have adequate liquidity

- give Canadian households and businesses access to the credit they need"

With the economic outlook remaining highly uncertain, the BoC erred on the side of caution in projecting mortgage arrears and non-performing business loans based on the more severe economic scenario it laid out in the April Monetary Policy Report. The pessimistic reading would be that even with policymakers’ extraordinary actions, that scenario would see mortgage and business loan delinquencies eclipse previous peaks. A more optimistic reading would be that policy support has prevented a significantly worse outcome, and a resilient financial system will be able to absorb losses and leave the foundation in place for an eventual economic recovery. And, as Governor Poloz mentioned, a better economic scenario is still within reach as many provinces are beginning to gradually re-open their economies.

The projections in today’s FSR are based on a scenario in which Canadian GDP is 30% lower in Q2 and recovers slowly thereafter. In that scenario, mortgage arrears are projected to increase to 0.8% by mid-2021 from 0.25% at the end of 2019--nearly double the peak in arrears seen in 2009. Meanwhile, non-performing business loans are forecast to rise to 6.4% at the end of this year from 1% at the end of last year, significantly higher than past peaks of less than 5% in 2003 and 2010.

The upshot is that while we might see a significant increase in mortgage arrears and troubled loans over the next two years in this pessimistic economic scenario, these outcomes would have been much worse without the extraordinary programs that have been put in place to support businesses and households. That has important implications for the banking sector. The BoC’s analysis suggests that, with these policy measures, large bank’s existing capital buffers should be sufficient to absorb losses. Without those interventions, “banks would be faring much worse, with important negative effects on the availability of credit to households and businesses.”

Of course, the pandemic shutdown has strained the financial wherewithal of many households and businesses. That was deemed the price we must pay to mitigate the severe health threat and contain its spread. The BoC report acknowledges the economic fallout of the necessary measures and promises to take additional actions to assure the economy returns to its full potential growth path as soon as feasibly possible. Cushioning the blow for those most in need.

Nevertheless, there are businesses that will close permanently and others that will scoop up declining competitors. Some will benefit from the new opportunities created by social distancing, enhanced sanitation, remote activity, new forms of entertainment and advances in healthcare. Others will no doubt die, although many of these companies were at death's door before the pandemic emerged. Creative destruction is always painful for the losers, but it opens the way for many new winners and those existing businesses and individuals that are creative enough to adapt quickly to the changing environment.

The projections in today’s FSR are based on a scenario in which Canadian GDP is 30% lower in Q2 and recovers slowly thereafter. In that scenario, mortgage arrears are projected to increase to 0.8% by mid-2021 from 0.25% at the end of 2019--nearly double the peak in arrears seen in 2009. Meanwhile, non-performing business loans are forecast to rise to 6.4% at the end of this year from 1% at the end of last year, significantly higher than past peaks of less than 5% in 2003 and 2010.

The upshot is that while we might see a significant increase in mortgage arrears and troubled loans over the next two years in this pessimistic economic scenario, these outcomes would have been much worse without the extraordinary programs that have been put in place to support businesses and households. That has important implications for the banking sector. The BoC’s analysis suggests that, with these policy measures, large bank’s existing capital buffers should be sufficient to absorb losses. Without those interventions, “banks would be faring much worse, with important negative effects on the availability of credit to households and businesses.”

Households:

- 1 in 5 households don’t have enough cash or liquid assets to cover two months of mortgage payments

- Government support programs (CERB payments and CEWS wage subsidies) will cover a large share of households’ “core” spending (food, shelter, and telecoms)

- Loan payment deferrals (banks have allowed more than 700,000 households to delay mortgage payments) and new borrowing can help offset remaining income losses

- Still, some households are likely to fall behind on their debt payments (first credit cards and auto loans, then mortgages)—something we’re already seeing in Alberta and Saskatchewan

- There have been some signs of reduced funding stress in April: The Bank of Canada's bankers' acceptance program is shrinking, the drawdowns of credit lines have slowed as some borrowers are repaying, and corporate debt issuance picked up significantly in April after ceasing in March.

- Surveys show higher-than-normal rejection rates for small- and medium-sized businesses requesting additional funding from financial institutions

- Upcoming corporate debt refinancing needs are in line with historical levels, but many borrowers will face in increased costs of funds owing to elevated corporate risk spreads

- Nearly three-quarters of investment-grade corporate bonds are rated BBB (the lowest investment grade rating)—downgrades would double the stock of high-yield debt and significantly increase funding costs for those borrowers

- Firms in the industries most affected by COVID-19 tend to have smaller cash buffers, and a sharp drop in revenues will make it difficult to meet fixed costs including debt payments. What started as a cash flow problem could develop into a solvency issue for some businesses

- The energy sector is facing particular challenges: it has had to rely more on credit lines, has the highest refinancing needs over the next six months and faces the most potential downgrades

Banks:

- BoC’s term repos have provided ample liquidity to the banking system and reduced funding costs, hence the drop in some banks' posted and contract mortgage rates

- Take-up of term repos has slowed in recent weeks—an indication of improved market functioning

- Regulators have eased capital and liquidity requirements

Governments:

- The BoC’s asset purchases have helped improve liquidity in the key Government of Canada securities market (the baseline for many other bond markets)

- The FSR made little mention of government debt sustainability, but in his press conference Governor Poloz noted that overall government debt levels are similar to 20 years ago, and federal debt is significantly lower, giving the federal government plenty of room to maneuver

Of course, the pandemic shutdown has strained the financial wherewithal of many households and businesses. That was deemed the price we must pay to mitigate the severe health threat and contain its spread. The BoC report acknowledges the economic fallout of the necessary measures and promises to take additional actions to assure the economy returns to its full potential growth path as soon as feasibly possible. Cushioning the blow for those most in need.

Nevertheless, there are businesses that will close permanently and others that will scoop up declining competitors. Some will benefit from the new opportunities created by social distancing, enhanced sanitation, remote activity, new forms of entertainment and advances in healthcare. Others will no doubt die, although many of these companies were at death's door before the pandemic emerged. Creative destruction is always painful for the losers, but it opens the way for many new winners and those existing businesses and individuals that are creative enough to adapt quickly to the changing environment.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was originally published on her newsletter.

RECENT POSTS

Did you know there’s a program that allows you to use your RRSP to help come up with your downpayment to buy a home? It’s called the Home Buyer’s Plan (or HBP for short), and it’s made possible by the government of Canada. While the program is pretty straightforward, there are a few things you need to know. Your first home (with some exceptions) To qualify, you need to be buying your first home. However, when you look into the fine print, you find that technically, you must not have owned a home in the last four years or have lived in a house that your spouse owned in the previous four years. Another exception is for those with a disability or those helping someone with a disability. In this case, you can withdraw from an RRSP for a home purchase at any time. You have to pay back the RRSP You have 15 years to pay back the RRSP, and you start the second year after the withdrawal. While you won’t pay any tax on this particular withdrawal, it does come with some conditions. You’ll have to pay back the total amount you withdrew over 15 years. The CRA will send you an HBP Statement of Account every year to advise how much you owe the RRSP that year. Your repayments will not count as contributions as you’ve already received the tax break from those funds. Access to funds The funds you withdraw from the RRSP must have been there for at least 90 days. You can still technically withdraw the money from your RRSP and use it for your down-payment, but it won’t be tax-deductible and won’t be part of the HBP. You can access up to $35,000 individually or $70,00 per couple through the HBP. Please connect anytime if you’d like to know more about the HBP and how it could work for you as you plan your downpayment. It would be a pleasure to work with you.

If you’re new to the home buying process, it’s easy to get confused by some of the terms used. The purpose of this article is to clear up any confusion between the deposit and downpayment. What is a deposit? The deposit is the money included with a purchase contract as a sign of good faith when you offer to purchase a property. It’s the “consideration” that helps make up the contract and binds you to the agreement. Typically, you include a certified cheque or a bank draft that your real estate brokerage holds while negotiations are finalized when you offer to purchase a property. If your offer is accepted, your deposit is held in your Realtor’s trust account. If your offer is accepted and you commit to buying the property, your deposit is transferred to the lawyer’s trust account and included in your downpayment. If you aren’t able to reach an agreement, the deposit is refunded to you. However, if you commit to buying the property and don’t complete the transaction, your deposit could be forfeit to the seller. Your deposit goes ahead of the downpayment but makes up part of the downpayment. The amount you put forward as a deposit when negotiating the terms of a purchase contract is arbitrary, meaning there is no predefined or standard amount. Instead, it’s best to discuss this with your real estate professional as your deposit can be a negotiating factor in and of itself. A larger deposit may give you a better chance of having your offer accepted in a competitive situation. It also puts you on the hook for more if something changes down the line and you cannot complete the purchase. What is a downpayment? Your downpayment refers to the initial payment you make when buying a property through mortgage financing. In Canada, the minimum downpayment amount is 5%, as lenders can only lend up to 95% of the property’s value. Securing mortgage financing with anything less than 20% down is only made possible through mortgage default insurance. You can source your downpayment from your resources, the sale of a property, an RRSP, a gift from a family member, or borrowed funds. Example scenario Let’s say that you are looking to purchase a property worth $400k. You’re planning on making a downpayment of 10% or $40k. When you make the initial offer to buy the property, you put forward $10k as a deposit your real estate brokerage holds in their trust account. If everything checks out with the home inspection and you’re satisfied with financing, you can remove all conditions. Your $10k deposit is transferred to the lawyer’s trust account, where will add the remaining $30k for the downpayment. With your $40k downpayment made, once you sign the mortgage documents and cover the legal and closing costs, the lender will forward the remaining 90% in the form of a mortgage registered to your title, and you have officially purchased the property! If you have any questions about the difference between the deposit and the downpayment or any other mortgage terms, please connect anytime. It would be a pleasure to work with you.