Canadian Economy Ended 2020 On An Extremely Upbeat Note

Strong Canadian Economic Growth in Q4 and January

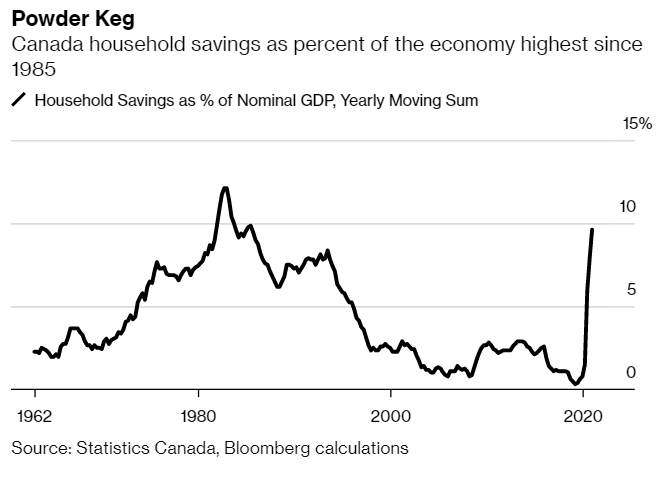

Consumer spending was weak at the end of last year, not surprisingly given many stores were closed and a stay-at-home order was in place in several highly populated areas. Households have been hoarding cash. The savings rate declined to 12.7% in Q4 from as high as 27.8% earlier in the year, but that is still way above normal. Accumulated savings will provide a backstop for robust consumer spending once the economy opens up.

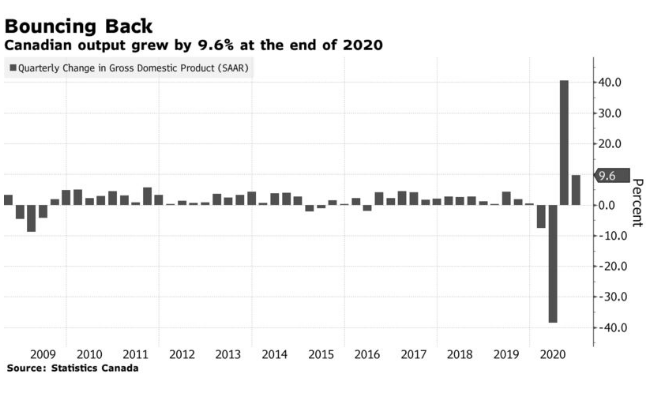

For all of 2020, the Canadian economy contracted by 5.4%–a substantially harder hit than in the US, which posted a 3.5% decline.

Bottom Line

The stronger-than-expected economy raises the potential that there is enough stimulus in the economy. The Trudeau government appears to be determined to hike government spending meaningfully in the next federal budget (likely coming this Spring). We know it is the government’s predilection to juice the economy for another couple of years, but that could well deserve a rethink.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was syndicated with permission.