Blockbuster Canadian Jobs Report for March

Blowout Canadian Job Growth Continued In March

This morning, Statistics Canada released the March 2021 Labour Force Survey showing much stronger-than-expected job growth for the second month in a row, pointing towards a Q1 growth rate of more than 5.5%. This survey reflected labour market conditions during the week of March 14 to 20, when public health restrictions were less restrictive in several provinces than during the prior month.

Employment surged by a whopping 303,100 in March after a gain of 259,200 in February. The jobless rate fell to 7.5%, the lowest since before the pandemic. However, there remain many discouraged workers who are no longer actively looking for jobs but would prefer to be gainfully employed. Many of them might well be mothers who could not afford or find quality daycare or needed to help children with remote learning.

The employment rate–the percentage of the population aged 15 and older that is employed—increased 0.9 percentage points to 60.3%, which was still 1.5 percentage points below the rate seen in February 2020.

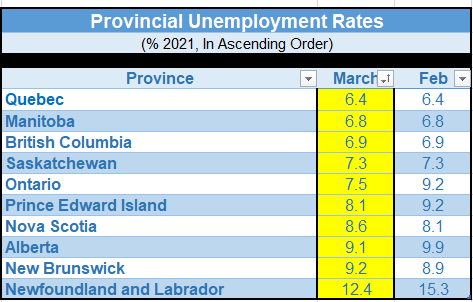

Employment gains in March were spread across most provinces, with the largest increases in Ontario, Alberta, British Columbia and Quebec. Much of the employment increase reflected a continued recovery in industries—including retail trade and accommodation and food services—where employment had fallen in January in response to public health restrictions. Growth in health care and social assistance, educational services, and construction also contributed to the national increase in March.

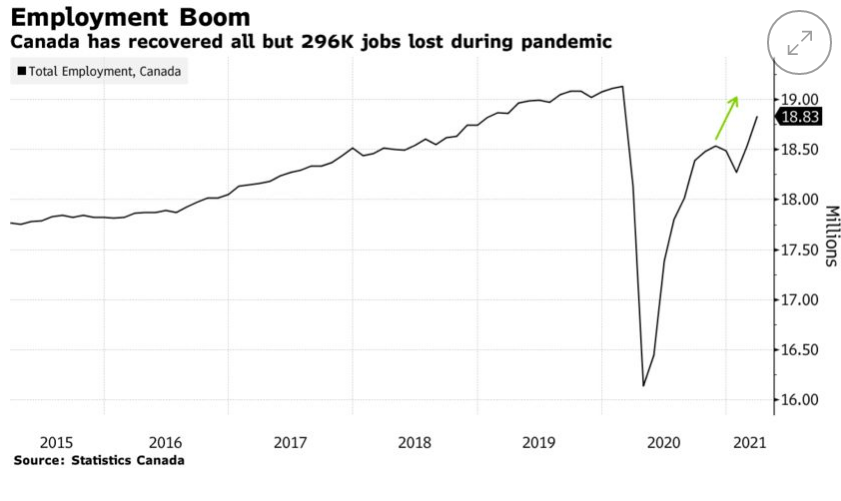

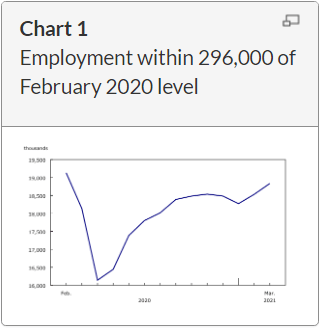

The COVID-19 pandemic continues to impact the labour market. Compared with February 2020, there were 296,000 (-1.5%) fewer people employed in March 2021 and 247,000 (+30.4%) more people working less than half of their usual hours. The number of workers affected by the COVID-19 economic shutdown peaked at 5.5 million in April 2020, including a drop in employment of 3.0 million and an increase in COVID-related absences from work of 2.5 million.

Among workers who worked at least half their usual hours in March, the number working at locations other than home increased by about 600,000 for the second consecutive month as public health restrictions eased across the country.

While the number of Canadians working from home declined by 200,000 in March, working from home remains an important adaptation to the COVID-19 pandemic. Of the 5.0 million Canadians working from home in March, more than half (2.9 million) were doing so temporarily in response to COVID-19.

Total hours worked rose 2.0% in March, driven by gains in several industries, including educational services, retail trade, and construction. Building on a steady upward trend since April 2020, this brought total hours to within 1.2% of February 2020 levels. Hours worked among the self-employed continued to be much further behind (-7.7%) February 2020 levels, while hours among employees returned to pre-pandemic levels.

The unemployment rate falls to the lowest level since the start of the pandemic

The unemployment rate declined for the second consecutive month, falling 0.7 percentage points to 7.5% in March, the lowest since February 2020. This reflected strong employment growth that exceeded the number of people entering the labour market.

The number of people unemployed fell 148,000 (-8.9%) in March, with the majority (59.0%) of people leaving unemployment becoming employed. Despite sharp reductions in both February and March, the number of people unemployed stood at 1.5 million, up 371,000 (+32.4%) compared with February 2020.

The number of long-term unemployed—people who had been looking for work or on temporary layoff for 27 weeks or more—held steady in March. There were 286,000 (+159.5%) more people in long-term unemployment compared with February 2020. These are the folks that could be permanently scarred by the pandemic and for whom job training may well be helpful.

Bottom Line

While Friday’s jobs report surprised on the upside, there are still concerns around an uneven recovery and the impact of the third-wave shutdown in the economy. As the virus becomes more contagious and lethal, the economic recovery remains at risk, heightened by the vaccine’s very slow rollout. The reduces the importance of this employment report for the Bank of Canada even though it is the last report before the central bank’s April policy decision. No doubt the Bank of Canada will highlight the rising risk of contagion on the economic recovery.

Prime Minister Justin Trudeau’s government will release its 2021 budget on April 19 and has already promised an additional spending dose. The Bank of Canada’s next policy decision is on April 21. The Bank will thus maintain the overnight rate at 25 basis points and refrain from tapering quantitative easing.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was syndicated with permission.