Bank of Canada Holds Rates Steady, But Pares Bond-Buying Program

Bank of Canada Scales Back Bond Buying

Today, the Bank of Canada held its target for the overnight rate at the effective lower bound of ¼ percent. The Bank is also adjusting its bond-buying program from weekly net purchases of Government of Canada (GoC) bonds of $4 billion to $3 billion. This adjustment to the amount of incremental stimulus being added each week reflects the progress made in the economic recovery.

Finally, the Bank now suggests that the remaining slack in the economy could be fully absorbed by the second have of 2022–rather than 2023, suggesting that they may begin raising overnight interest rates before the end of next year. The Bank went on to aver that this timing is more uncertain than usual, however, given the uncertainty around potential output and the highly uneven impacts of the pandemic.

The Bank of Canada now believes that first-quarter growth in Canada is considerably stronger than they were expecting back in the January Monetary Policy Report (MPR). This partly reflects a better global backdrop, particularly in the United States. The US recovery is supported by a rapid rollout of vaccines and substantial fiscal stimulus, bringing spillover benefits to Canada through higher demand for exports and stronger commodity prices.

“But the most important factor in the unexpected economic strength has been the resilience and adaptability of Canadian households and businesses. Lockdowns through the second wave had much less economic impact than they did through the first wave. The economy bounced back quickly with the eased restrictions posting substantial job gains in February and March. The third wave is a new setback, and we can expect some of these job gains to be reversed. But the performance of the economy in recent months has increased our confidence in the underlying strength in the recovery.”

The Bank went on to say, “With the vaccine rollout progressing, we are expecting strong consumption-led growth in the second half of this year. Fiscal stimulus from the federal and provincial governments will also make an important contribution to growth. Strong growth in foreign demand and higher commodity prices are expected to drive a solid rebound in exports and business investment, leading to a more broad-based recovery. Overall, we now project that the economy will expand by around 6½ percent this year, slowing to about 3¾ percent in 2022 and 3¼ percent in 2023.

Over the next few months, inflation is expected to rise temporarily to around the top of the 1-3 percent inflation-control range. This is largely the result of base-year effects—year-over-year CPI inflation is higher because prices of some goods and services fell sharply at the start of the pandemic. Also, the increase in oil prices since December has driven gasoline prices above their pre-pandemic levels. The Bank expects CPI inflation to ease back toward 2 percent over the second half of 2021 as these base-year effects diminish, and inflation is expected to ease further because of the ongoing drag from excess capacity. As slack is absorbed, inflation should return to 2 percent on a sustained basis sometime in the second half of 2022.

Bank of Canada “Forced” To Taper

When the pandemic first hit, the BoC bought government securities, providing liquidity to assure the full functioning of the market. As liquidity conditions in the Government of Canada (GoC) bond market improved, the primary objective of central bank bond purchases shifted toward a focus on monetary stimulus. The quantitative easing (QE) purchases of bonds continue to put downward pressure on borrowing rates, supporting economic activity. QE also reinforces monetary stimulus provided by the Bank’s forward guidance. This guidance has committed to holding the policy interest rate (the overnight rate) at its effective lower bound until economic slack is absorbed, so the inflation target is sustainably achieved.

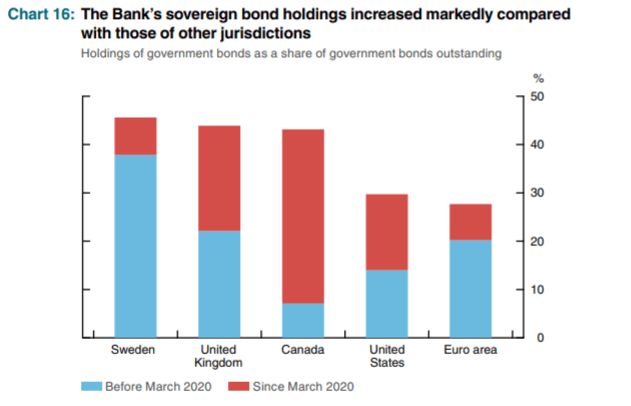

The Bank’s total ownership of GoC bonds outstanding has increased to about 42 percent. Since March 2020, the Bank has purchased more than 35 percent of total sovereign bonds outstanding, a higher percentage than other central banks (see chart below). Considering the size of Canada’s bond market and its economy, this means that the Bank has provided an extraordinary amount of stimulus. The Bank must continue to taper its purchases to ensure sufficient tradeable GoCs are available for longer-term institutional investors–such as insurance companies and pension funds–that must hold triple-A debt to offset their long-term liabilities.

Bank of Canada Assessment of the Housing Market

In today’s MPR, the Bank of Canada included an assessment of the drivers of the strength in Canadian housing:

- Demand has been supported by relatively high disposable incomes and low mortgage rates.

- While job losses have risen during the pandemic, they have been concentrated among low-wage earners who tend to rent their homes rather than buy them.

- Remote work and more time spent at home have led to stronger demand for larger, single-family homes and housing in suburban and rural areas.

- One implication of this shift in demand is a pickup in new housing construction in regions with fewer supply constraints, such as limited availability of land.

- Over the past year, the pace of construction has been hampered by containment measures and shortages of materials and skilled workers. These factors are also putting upward pressure on construction costs.

- Some potential sellers have been reluctant to show their homes during the pandemic.

- Over time, supply is expected to adjust. A large number of building permits have been issued, with a growing share for single-family homes. Housing starts have also risen significantly in recent months, most notably in rural areas.

The Bank remains concerned about extrapolative expectations leading to overheated price increases and speculative activity (see chart below). They welcome the proposed changes to the Guideline B-20 by the Office of the Superintendent of Financial Institutions to help reduce these risks.

Bottom Line

This was a significant BoC announcement, suggesting a turning point in their thinking. The worst of the pandemic is over, the economy has been remarkably resilient, and the Bank can now see the light at the end of the tunnel. That light is now expected in the second half of 2022, rather than 2023. Although the policy rate will remain at its effective lower bound until then, the central bank has already begun to pare back its GoC bond buying.

Some of the Bank’s optimism reflects the comparative strength of the US economy, which is way ahead of Canada’s vaccine distribution.* The spillover effects of that are meaningful in terms of Canadian exports. The fiscal stimulus evident in this week’s federal budget also provides a ballast for the economy. Although an estimated 425,000 people are still insufficiently employed and the third wave containment measures and vaccine rollout are unpredictable, the Bank is more confident now than any time in the past thirteen months that we will attain full-employment by late next year.

*As of April 20, nearly 25% of the US population has been fully vaccinated and 39% have received at least one vaccine. In comparison, as of April 20, only 2.5% of the Canadian population has been fully vaccinated and 25.4% have had one vaccine.

This article was written by DLC's Chief Economist Dr Sherry Cooper and was syndicated with permission.